According to CBRE’s Q1 2018 office market report, the Long Island commercial office market started off 2018 with steadied fundamentals. The impetus to the market’s overall heath was due to limited new construction, tenants relocating to higher-quality office space, and continued strong demand from the healthcare sector.

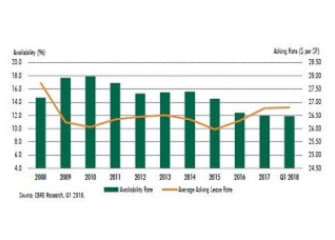

Overall availability rates and average asking lease rates remained virtually unchanged since Q4 2017. Long Island’s Q1 2018 availability rate registered 11.9%, while the overall average asking rent closed at $26.80 per sq. ft. The market posted relatively strong quarterly leasing activity of 510,000 sq. ft. led to positive net absorption of 160,000 sq. ft. which was driven by 201,000 sq. ft. of net absorption in Class B space.

“After three straight quarters of lackluster leasing, activity picked up significantly during the first quarter of 2018, especially in Nassau County,” said Ellen S. Rudin, senior managing director of CBRE’s Long Island and New York City Outer Boroughs offices. “Large tenants led the way for leasing with a number of major transactions, like Sterling National Bank’s 111,000-sq.-ft. expansion/extension and NYU Winthrop Hospital’s 77,500-sq.ft. lease in Mineola. These large tenants are one of the key factors helping the Long Island office market start to reach supply/demand equilibrium.”

Large blocks of office space remained in demand, and in short supply, through the first quarter of 2018. Although there are only a few large Class A spaces available in Nassau and Suffolk Counties, developers are not considering speculative construction to meet demand due to high construction costs and stable rental rates. Given the lack of new construction and that Long Island’s Class A vacancy rate is currently at 8.2%, the CBRE report predicts that rents will likely continue to remain stable and inch up across Class A properties in 2018.

You can download the full Long Island Q1 market report here.

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBRE), a Fortune 500 and S&P 500 company headquartered in Los Angeles, is the world’s largest commercial real estate services and investment firm (based on 2017 revenue). The company has more than 80,000 employees (excluding affiliates), and serves real estate investors and occupiers through approximately 450 offices (excluding affiliates) worldwide. CBRE offers a broad range of integrated services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. Please visit our website at www.cbre.com.