Investment Thesis

When it comes to investing in out of favour, free cash flow-generating businesses, I would like to think that I know a thing or two on the subject. In fact, I have a lot of passion for investing in out-of-favour businesses with cheap price tags. The problem with IBM Corp. (NYSE:IBM) is that, while it is indeed out of favour, I argue in this article that it is out of favour for the correct reasons and priced accordingly.

Background

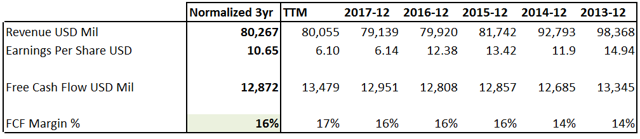

I have posted below a snapshot of the key financial numbers from the company's financials.

Source: Author's calculations, Morningstar.com

Immediately, it becomes obvious that IBM is very free cash flow-generative. With a free cash margin of 16% (normalized), which reiterates the widely known fact that IBM is an asset-light business; with strong returns on invested capital. Hopefully, thus far, shareholders would have no argument with my reasoning.