What happened

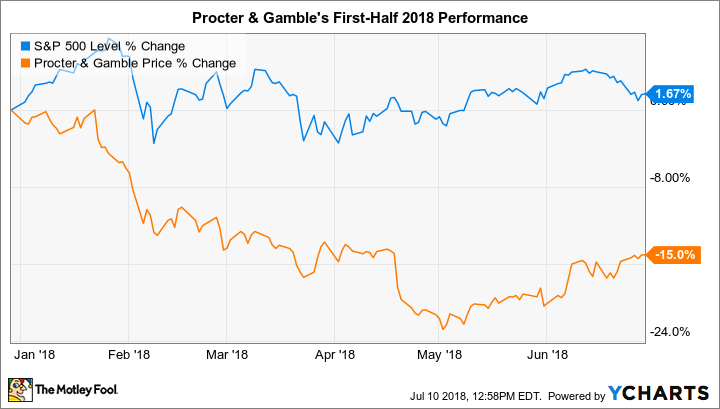

Returns for Procter & Gamble (NYSE:PG) shareholders have underperformed the market through the first six months of 2018. The stock fell 15% in that period as the S&P 500 gained 2%, according to data provided by S&P Global Market Intelligence.

The slump has contributed to a rough run for P&G investors, who've seen their shares stay flat over the past five years compared to a 69% spike in the broader market.

So what

P&G's big problem has been sluggish sales growth. Its revenue ticked up by just 1% in the most recent quarter to mark a slowdown from the prior quarter's disappointing 2% increase. In explaining the results, CEO David Taylor cited pricing pressures across the consumer staples industry. "The ecosystems in which we operate around the world," Taylor said, "are being disrupted and transformed."

IMAGE SOURCE: GETTY IMAGES.

Now what

The good news: Procter & Gamble's costs are still trending lower. It remains a fantastically efficient business that generates tons of free cash flow and market-leading profitability, too. These characteristics support ample cash returns to shareholders in the form of dividends and share buybacks.

Yet the multiyear slump in the stock isn't likely to end until the owner of the Pampers and Gillette franchises can use those brands to return to at least modest market-share growth.

Procter & Gamble is not on our top "Buy" list, but these 10 stocks areInvesting geniuses David and Tom Gardner just released their best stocks to buy now -- and it could pay to listen. Especially when you consider their average stock pick is up 353% vs. a mere 81% for the S&P 500.

They just shared what they think are the ten best stocks for investors to buy right now to members inside their service Motley Fool Stock Advisor… and Procter & Gamble wasn't one of them! That's right -- they think these 10 stocks are even better buys.