Summary

Another nice Q2 beat from SIRI.

Churn surprised at record lows.

Buybacks have slowed.

Margins boosted by low churn, acquisition costs and higher ARPU.

Consider exposure through the Liberty tracker.

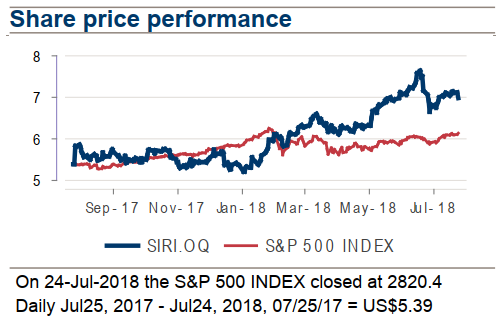

If there’s a stock that has defied expectations in 2018, Sirius XM (SIRI) has got to be a strong candidate. The stock suffered numerous Street downgrades throughout the year on valuation concerns, yet SIRI currently trades at ~30x P/E, a premium to the media sector. YTD, however, the stock has returned >30%, outperforming the broader index.

(Source: Credit Suisse)

A large part of the outperformance is a direct result of the lower domestic tax rate. As Sirius XM generates virtually all its cash flow domestically, the tax cut to 21% (from ~35% before) boosted terminal value significantly and drove valuations upward.