Summary

Philip Morris has drastically underperformed the stock market over the past year. Philip Morris revising its full year guidance has only continued downward momentum.

The stock remains a cash flow powerhouse, and is offering multi-year highs in both dividend yield, and free cash flow yield.

IQOS still has a ton of room to grow. There are markets to develop, and the company is getting ready to launch new generation hardware.

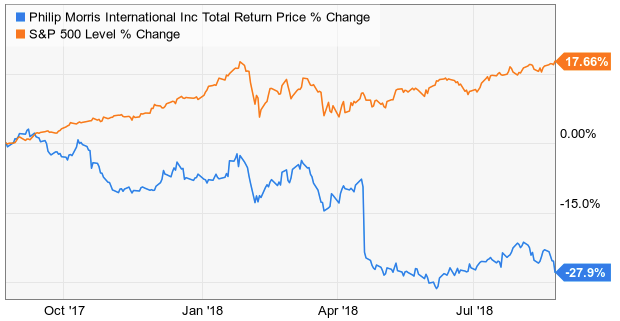

Philip Morris International (PM) has been an absolute dog for investors over the past year. While the S&P 500 has soared to new highs, gaining almost 18%, Philip Morris has declined almost 28%. Despite the sterling reputation that tobacco companies have among dividend growth investors, investor confidence in Philip Morris appears to be hitting multi-year lows.

source: Ycharts

source: Ycharts

The company lowered guidance at its second quarter earnings call, and Jefferies has sharply lowered its price target based on bearish sentiments regarding IQOS. Despite these recent negative developments, investors with a long term mindset can take advantage of these circumstances. There are numerous reasons why Philip Morris' recent struggles represent an excellent long term opportunity.