Summary

- Big blue has transformed itself from maker of computers to technology consultants - there's no reason why it can't transform into a major cloud competitor.

- The stock has been beaten down by the market and now looks like a deep value play with lots of upside.

- It might be one of the most attractive dividend payers in the technology sector with a 4.8% dividend yield and a potential price of $180.

- Looking for more? I update all of my investing ideas and strategies to members of The Income Strategist. Start your free trial today »

A couple of months ago, I published an article called Microsoft (NASDAQ:MSFT) Might be the Best Technology Dividend Play. The stock is up 4% since then based on our thesis for potential dividend growth is not necessarily the current dividend yield. We are still waiting for a dividend boost sometime this quarter or next, but in the meantime, we found another tech company, and this one pays a hefty 4.9% dividend. Is it better? Perhaps we were too quick to name "the best technology dividend play." Or maybe there's room in our technology allocation for both.

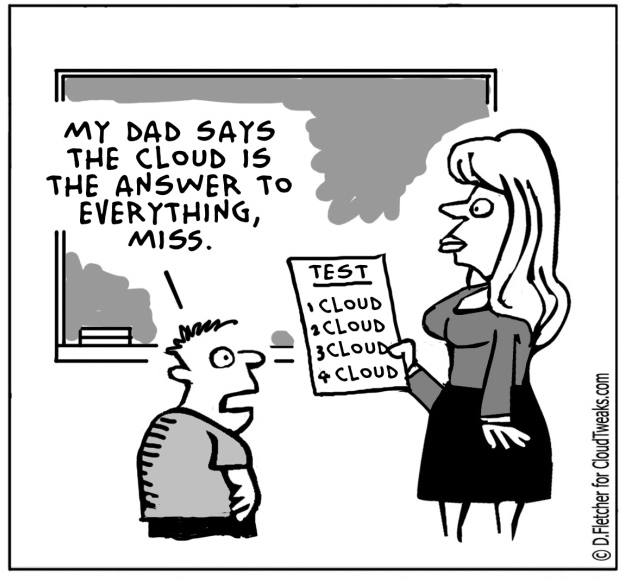

Source: CloudTweaks.com

Major corporations around the globe are embarking on a journey of digital transformation by adopting sophisticated digital technologies like data analytics, artificial intelligence, unified communications, IoT, cyber security, and blockchain. In order to implement these emerging technologies effectively, it's essential to migrate enterprise IT workloads from on-premise hardware to cloud-based or Internet-based computer resources that can be made available to users on demand via the Internet.