Summary

- IBM has not capitalized on any significant tech trends in the last 20 years and instead stayed wedded to mainframes for far too long.

- The continuing decline in revenues and earnings is cutting into the margin of safety on its dividend.

- IBM is not a leader in the cloud space and the Red Hat acquisition will load it with added debt.

- IBM is not a safe reliable investment and it could be one slow-down away from the need to cut its dividend.

IBM (IBM) is an iconic American brand that was once a titan of industry at its zenith. Many investors still think of IBM as a “blue chip” investment that is safe and reliable. Indeed, the old adage for portfolio managers was “nobody ever got fired for buying IBM.” But like many companies that were wildly successful for a period in time, the company has failed to catch lightning in a bottle again.

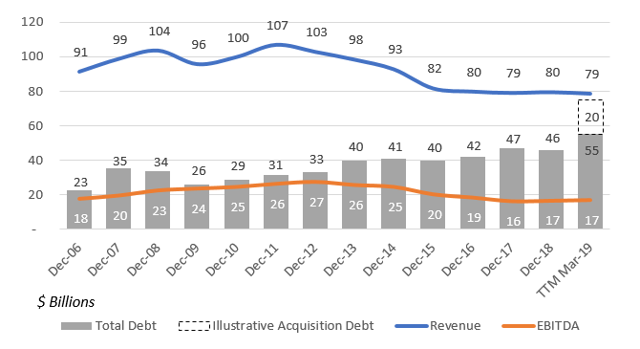

Below I will outline IBM’s several missteps as the company has clung to dying technology, “bet the ranch” on Watson, and is late to the cloud market and take a look at its cash flows to determine if its dividend is at risk. As the chart below illustrates, IBM's results have been deteriorating for nearly a decade now. As management has desperately spent its cash and borrowed money on failed endeavors, it is quickly arriving at a point where its debt burden will severely restrain the firm. I don’t think a comparison to GE’s doldrums would be an exaggeration.

Source: Figures from S&P Cap IQ