Summary

- PM & MO pay strong dividends.

- Several tobacco companies have good chart setups for upside.

- Smoke (Combustibles) may be somewhat stagnant, but Reduced-Risk continues to heat up.

Recently we noticed both Philip Morris (PM) and Altria Group (MO) displaying some nice intermediate term setups for moves higher. We discuss in the video below along with a few other related tobacco charts that may be forming bottoms as well.

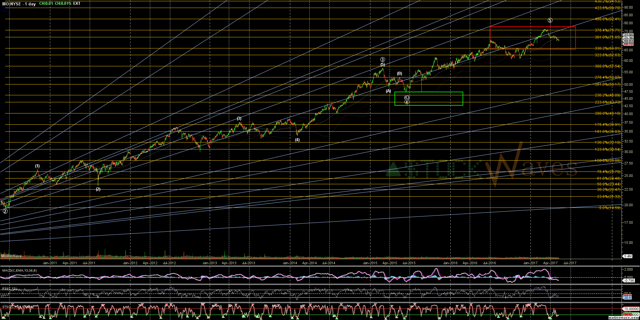

PM & MO where names that we had been projecting large corrections to begin since May 2017. Both completing five waves up from 2008/2009 lows into the June 2017 highs.

Inside these larger corrections PM & MO are both inside large B-wave bounces. Both have initial moves up from December 2018 lows and corrective retraces into Fibs support. This forms "A-B" setups for C-Waves higher which should take prices higher into 2020.

Inside these larger corrections PM & MO are both inside large B-wave bounces. Both have initial moves up from December 2018 lows and corrective retraces into Fibs support. This forms "A-B" setups for C-Waves higher which should take prices higher into 2020.

PM's chart only starts in mid 2008. It did follow a normal "#CABpIPO" pattern into the 2009. The five waves up at Primary degree from there into the 2017 top can be a Cycle degree wave I, and the (A.)-(B.) off the December low inside the larger Primary B wave bounce of the possible Cycle wave II retrace. The (C.) wave of the larger B targets 107s. This region has perfect Fibonacci confluence as the 100% extension of the (C.) wave and then 78.6% retrace of the entire move down from 2017. That is a projected 35% rally with support here in the 74s in addition to the very attractive current dividend yield of 5.73%.

MO's chart has a more significant low in early 2000 where we begin its' Elliott Wave count. It counts best as a Super Cycle degree wave (IV) now that is only half-way through. The Primary A-B off December here sets up for a C-wave in the Cycle b targeting 62-64. In similar proportions to PM this 28-30% projected rally fits with the 100% move for the C and the 76.4% retrace of the Cycle a down from 2017. While the projected returns are slightly more modest than PM, MO's current dividend yield is a whopping 6.51%!