Summary

- Accenture's new CEO, Ms. Julie Sweet, will take over a company that is already well-positioned for the future. Simply put, she will start the game with a pretty sweet hand.

- The company's industry is projected to grow materially over the next 5 plus years and, in my opinion, Accenture will be one of the direct beneficiaries.

- I hold a position in Accenture and I plan to stay long the stock.

- This idea was discussed in more depth with members of my private investing community, Going Long With W.G.. Start your free trial today »

Accenture (ACN) announced that its board approved the appointment of Ms. Julie Sweet as the company's next CEO, effective September 1, 2019. Ms. Sweet has been apart of Accenture's senior leadership team for over a decade and she currently serves as the North American CEO.

Ms. Sweet has an extremely impressive background but, to be honest, no one truly knows how this appointment will play out for the company or its shareholders. However, what I do know is that Accenture has great long-term business prospects and that the company is already well-positioned for the future. Therefore, I believe that the new CEO will start the game with pretty sweet hand (see what I did there?).

The New CEO Will Start With A Pretty Sweet Hand

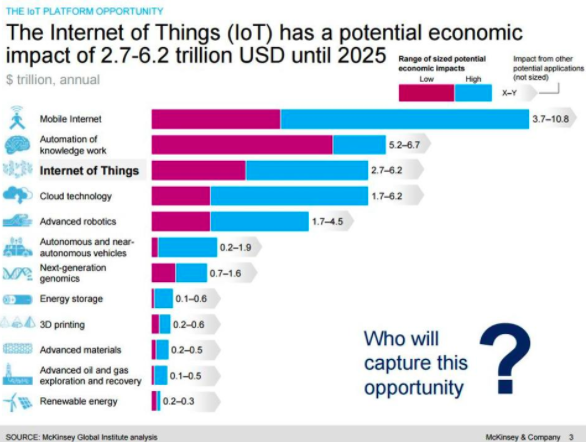

It would be an understatement to say that Accenture has promising long-term business prospects. To me, it is hard to find another technology consulting company (or company in general) that is as well-positioned as Accenture currently is. As I previously described here, Accenture is benefiting from operating in an industry that is experiencing significant growth. For example, the Internet of Things, or IoT, predictions all seem to project for the significant growth for the connected world to continue for years to come.

Source: Gartner

As shown, Gartner predicts that almost all new tech products (95%) will contain some type of IoT component by 2020. Furthermore, to put a dollar figure to the predictions, McKinsey & Company expects for IoT technology services to have a CAGR of 17% over the next five years and to reach $143B in spending by 2021.

Source: McKinsey & Company

And let's not forget that Accenture is already viewed as the go-to service provider in the IoT space. Moreover, this promising backdrop is only just getting started and, in my opinion, these estimates may actually turn out to be too conservative.

To this point, Accenture has been able to put up some strong operating results over the last few years.

| $ - in mill | 2018 | 2017 | 2016 | 2015 | 2014 | '14 to '18 |

| Revenues | $41,603 | $36,765 | $34,798 | $32,914 | $31,875 | 31% |

| % Chg | 13% | 6% | 6% | 3% | ||

| Operating Income | $5,841 | $4,633 | $4,810 | $4,436 | $4,301 | 36% |

| % Chg | 26% | -4% | 8% | 3% |

Source: Data from 2018 10-K; table created by author

A company with its top- and bottom-line up in excess of 30% over the last five years is impressive. Simply put, Accenture is in a sweet spot and the company's business should continue to be greatly impacted by several strong tailwinds that seem to be speeding up instead of slowing down. What's not to like?

It also helps the bull case that Accenture's recent operating results support the long-term story for this company.