Summary

- IBM easily surpassed Q2 EPS estimates, while revenues continue to struggle.

- A August 2 event to discuss updated financials for the Red Hat merger could trip up the stock.

- The stock remains exceptionally cheap at 10x FCF targets that are set to get an immediate boost.

In the last few days, a couple of noteworthy events occurred that should propel International Business Machines (IBM) forward after years of underperforming. The major catalyst might not even be on investors radars, making the investment thesis bullish as the stock enters a growth phase with the acquisition of Red Hat (RHT).

Image source: IBM website

Blah Results

With IBM trading right above $140, investors should be more excited by a big EPS beat. The tech giant earned $3.17 per share, with analyst expectations down at $3.07. Maybe, more importantly, the company beat the $3.08 earned in the prior year Q2.

IBM ended down fractionally in after-hours trading as the market is again focused on revenue growth or the inability of the tech giant to sustain growth. The company saw revenues slip 4.2%, with constant currency revenues only down 1.6%.

With over $19 billion in quarterly revenues, IBM shouldn't be judged so much on legacy revenues. The plan to hit EPS targets of at least $13.90 is far more interesting, and the inclusion of Red Hat going forward will matter far more than the past quarter.

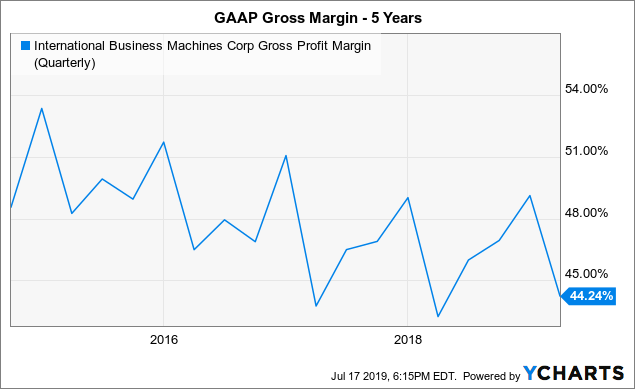

A prime reason for reaching EPS targets despite the weak revenues is the turnaround in gross margins. For Q2, the gross margin hit 47.0% for 100 basis point growth. The quarter continued a trend started in Q4'18, where the downward trend was broken, and now, IBM is growing margins again.

Data by YCharts

Data by YChartsAnalysts, apparently, have no faith in IBM actually hitting the goal, with 2019 EPS targets at exactly $13.90. The key here is that EPS targets slowly increase to a 2021 target of $14.56.