Summary

- IBM's revenue is in decline.

- Red Hat could jump-start hybrid cloud revenue and allow IBM to leverage its infrastructure.

- Deep cost cuts could spur IBM's bottom line going forward.

- I rate IBM a hold.

- Looking for a portfolio of ideas like this one? Members of Shocking The Street get exclusive access to our model portfolio. Start your free trial today »

Source: Barron's

Source: Barron's

In its most recent quarter, IBM (IBM) reported an EPS beat, but missed on revenue by $40 million. The stock is up nearly 5% post-earnings. I had the following takeaways on the quarter:

Red Hat's Revenue Impact Will Be Negligible ...

I have been an IBM bear for a while. The company has been transitioning from mainframe computing to cloud computing. Its legacy business has been winding down, while cloud revenue has been growing rapidly. Revenue from IBM's legacy business has been cascading downward, causing total revenue to fall. The new narrative surrounds its acquisition of Red Hat, and this has likely gotten investors excited.

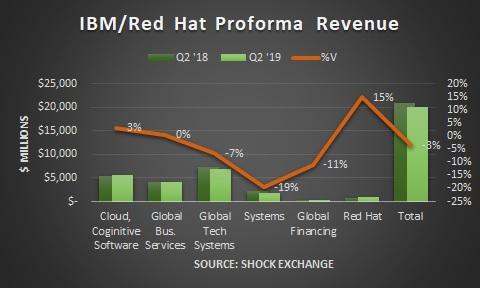

The following chart illustrates IBM/Red Hat pro forma revenue growth. IBM's Q2 2019 revenue of $19.2 billion was down 4% Y/Y. Including Red Hat's most recent quarterly revenue of $934 million, pro forma revenue would have been $20.1 billion, down 3%.

Revenue from Cloud & Cognitive Software was up 3% on growth in cloud and data platforms and cognitive applications. Global Business Services ("GBS") revenue was flat, but the segment did gain traction in some of the consulting services offered by IBM. The other IBM segments experienced declines. Global Technology Services ("GTS") is the largest segment at 34% of pro forma revenue. The company is managing the business for increased margin, profit, and cash contribution. This could hurt revenue growth, yet lead to improved margins.

Revenue from Cloud & Cognitive Software was up 3% on growth in cloud and data platforms and cognitive applications. Global Business Services ("GBS") revenue was flat, but the segment did gain traction in some of the consulting services offered by IBM. The other IBM segments experienced declines. Global Technology Services ("GTS") is the largest segment at 34% of pro forma revenue. The company is managing the business for increased margin, profit, and cash contribution. This could hurt revenue growth, yet lead to improved margins.

Red Hat's revenue grew by double digits in its most recent quarter. Its hybrid cloud offerings could make IBM one of the top players in hybrid cloud computing. For now, Red Hat would represent about 5% of IBM's pro forma revenue.