Summary

- IBM dipped on a cut to EPS targets following purchase accounting for the Red Hat merger.

- The tech giant forecasts FCF growing $500 million in 2020 and $1 billion in 2021.

- The dividend yield is up to 4.5% with cash flows to support annual dividend growth.

On Friday, International Business Machines (IBM) finally provided detailed financial projections on the Red Hat merger. The company had always provided an indication that the deal was immediately cash flow accretive while not EPS accretive until the end of year two. The headlines spooked investors, but the details should bring investors back with a smile.

Misleading Headlines

The market appeared shocked when IBM released details on the financial impact from the recently closed Red Hat merger. The headline-grabbing numbers centered on the EPS hit from purchase accounting with CNBC running this headline on Friday.

Source: CNBC

Source: CNBC

Along with the merger announcement, IBM predicted that the merger was initially EPS dilutive, but Red Hat was immediately cash flow positive. The company updated those expectations with the closing of the deal on July 9,

- accretive to free cash flow in the first year

- accretive to operating earnings per share by the end of the second year after closing (2021)

- dilutive to full-year 2019 earnings per share due primarily to a non-cash purchase accounting adjustment

My detailed research outlined how the cash flow generated by Red Hat would immediately offset the extra interest costs from the debt-fueled merger. Any revenue growth from the cloud leader, combined with repaying debt, would lead to positive cash flows.

The market appeared shocked when IBM provided those exact numbers. Possibly, investors weren't prepared for the tech giant to lower EPS estimates by $1.10 related to the merger. The new $12.80 EPS target for 2019 clearly caught some investors off guard.

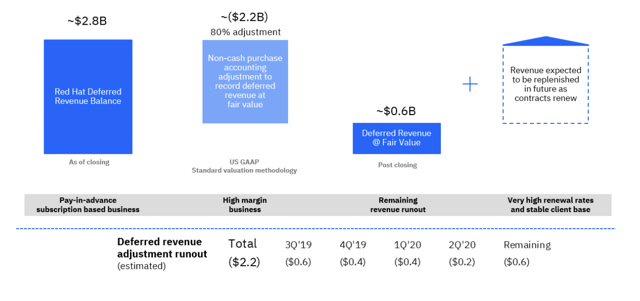

Due to purchase accounting, IBM had to adjust $2.2 billion worth of Red Hat's deferred revenue in a non-cash adjustment. The impact was a hit to future earnings because IBM won't count those revenues causing a $1.0 billion hit to revenues this year alone. The company outlines the quarterly impact in this chart and further details the financial treatment of the deferred revenue.

Source: IBM financial performance targets

The company further updated the impact to their 2019 EPS estimates from the transaction. The amount includes an $0.85 impact due to deferred revenue discussed above and another $0.25 for equity and retention costs. Most companies would just exclude these costs from non-GAAP numbers and call the merger impact a wash.