Summary

- IBM is at the inflection point of the turn-around and will return to sustainable long-term growth in the next year.

- The valuation does not reflect the improvements revenue composition and the consequent growth and margin outlook.

- I believe the stock is worth $165 an implied upside of 12%.

Why IBM is a BUY

IBM logo. Source: Wikipedia

IBM logo. Source: Wikipedia

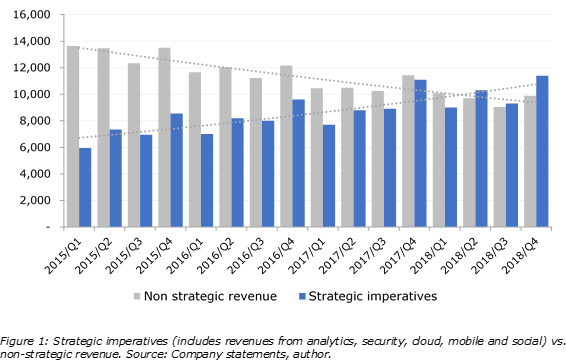

Although sentiment around International Business Machines (IBM) has shifted slightly since the Red Hat acquisition announcement, I still think it is overly pessimistic given the long-term improvements in the company’s revenue composition. Since FY18 more than half of IBM’s revenue come from generally growing areas (Strategic imperatives SIs) which will allow the return to sustainable revenue growth in the next year and will help stabilize operating margins after years of decline.

The last two quarters were underwhelming but mainly due to the headwinds from mainframe, portfolio restructuring in GTS and generally higher volatility of the growth segments. (It would be easier to assess if management hadn’t decided to discontinue reporting SIs in Q1 at a crucial time). But if we look at the longer term picture, growth has clearly improved with the increase of strategic revenues.

Additionally, this comes at a time where markets like AI, analytics (and security) which management had overhyped for a long time are finally starting to show promise and IBM is well positioned to take advantage.

Exhibit 1: Strategic imperative vs. non-strategic revenues (in USDm)

Exhibit 2: Regression of IBM's revenue growth on SIs as percent of total revenue (ex. Systems)