Summary

- Verizon Communications beat Q2 subscriber numbers in Q2.

- The decent quarter didn't alter the EPS picture.

- The company should hike the dividend by ~2% in early September.

- The dividend yield signals buying the stock in the low $50s for a peak price of $60.

A lot of investors celebrated the Q2 results from Verizon Communications(VZ). The domestic wireless giant generated some solid postpaid subscriber numbers, but the company isn't getting anywhere fast enough to alter the investment thesis of keying off the 4% dividend yield.

Solid Subscriber Numbers, But....

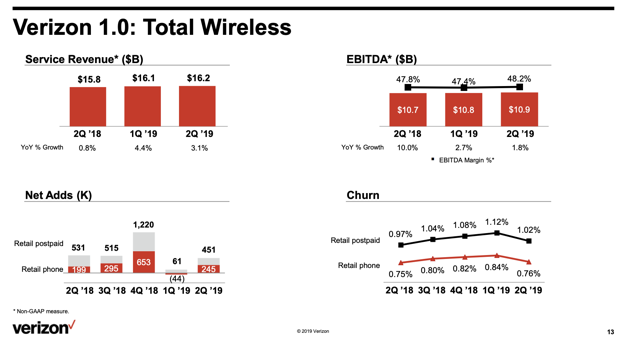

For Q2, Verizon generated impressive retail postpaid wireless additions of 451,000 and the all important phone postpaid additions were 245,000. The postpaid phone additions were higher than last Q2.

Source: Verizon Q2'19 presentation

The problem is that Verizon has ~120 million retail connections so a few hundred thousand new phone net adds doesn't move the needle. Verizon saw wireless service revenues creep up to $16.2 billion, but the rest of the company took a step back leading to revenue declining slightly to $32.1 billion.

The wireless EBITDA margins continue to expand from lowered cost. The 48.2% EBITDA margin was good enough for 1.9% growth over last year.

So the decent net postpaid phone growth ends up in a pile that amounts to $0.03 EPS growth over last year to reach $1.23. Sure lease accounting and deferred commission expense had a combined net impact to EPS by $0.04, but even adding that amount back only leads to an adjusted EPS of $1.27 for 6% growth. Most would argue with sticking with the $1.23 number that offers limited growth.

The end result is that analysts estimate that Verizon finally tops a $5 EPS estimate by 2021. The 5G add on fee of $10 just isn't going to contribute much in the way of a profit boost with 2% to 3% EPS growth expected through at least the next two years.