Summary

- In January 2019, Bristol-Myers Squibb announced it will acquire Celgene and the acquisition will be closed at the end of 2019 or beginning of 2020.

- With important products like Revlimid, Eliquis, and Opdivo, the company not only has products that generate a lot of revenue but also grow with a high pace.

- Both companies - Celgene and Bristol-Myers Squibb - have a rich pipeline that should contribute to growth.

- Bristol-Myers Squibb appears to be extremely undervalued, but analysts seem to be cautious if it could be a good long-term investment.

- Looking for a helping hand in the market? Members of Moats & Long-Term Investing get exclusive ideas and guidance to navigate any climate.Get started today »

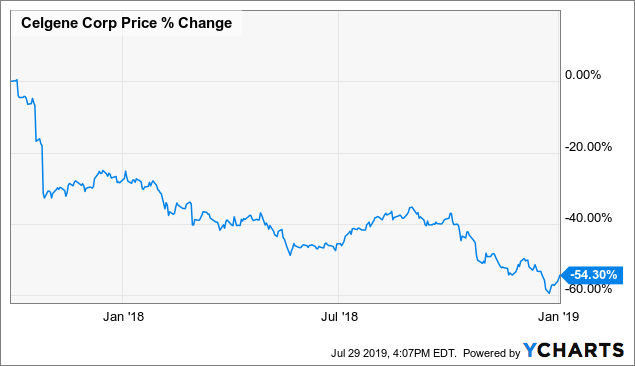

In June 2018, I have written my first and only article on Celgene (CELG) so far. In the article, I calculated an intrinsic value for Celgene of $100 (in the worst case) and ended the article with the advice to open a long position at $67, which would be a good long-term entry point. In December 2018, the stock price dropped even below that level, but before I could open any long position, Bristol-Myers Squibb (BMY) announced on January 3, 2019, that it will acquire Celgene.

Data by YCharts

Data by YChartsWhen considering a fair value of at least $100, Celgene would still be a great buy at current price levels, but as Bristol-Myers Squibb is about to acquire Celgene, we have to decide if Bristol-Myers Squibb is a good long-term investment. We have to ask ourselves the question if a long-term investor that would have bought Celgene a few months back (before the acquisition was announced) should also buy Bristol-Myers Squibb now.

The Deal

The deal between Bristol-Myers Squibb and Celgene was one of the larger deals announced in the last few quarters, where companies acquire competitors with a huge market cap and sometimes a market cap almost as high as the acquiring company itself. Celgene has a market cap of roughly $70 billion right now and Bristol-Myers Squibb has a market capitalization of $76 billion (it was higher at the time the acquisition was announced).

Of course, BMY had to pay a premium for Celgene (compared to the stock price Celgene was trading at that point), but I think management has proven it can execute at the right time and get Celgene extremely cheap. Especially in a market where many assets are extremely expensive and other companies are buying for huge premiums and making deals at extremely high prices, BMY didn't overpay for Celgene. In my last article about a year ago, I valued Celgene at $133 per share (in a more realistic intrinsic value calculation) and BMY's management offered $102.43 per share for Celgene.

Currently, there are 702 million outstanding Celgene shares and BMY will pay each shareholder $50, which means that BMY will need about $36.05 billion in cash when the deal is closed. After management has already taken on $24.4 billion in long-term debt, the company has currently $29.4 billion in cash on its balance sheet. Celgene also has $7.7 billion in cash on its balance sheet, which BMY can use to pay the $36 billion in cash to the shareholders. Aside from $50 in cash per share, Celgene shareholders will also receive one BMY share for every CELG share. This will, of course, increase the number of outstanding shares, and the current BMY shareholders will hold 69% while the current Celgene shareholders will hold 31% of the "new" company.

Assuming that BMY already has all the cash it needs to pay out $36 billion in cash to the Celgene shareholders, the "new" company would have a combined debt of $44.58 billion on its balance sheet. Adding up the operating income of Celgene and Bristol-Myers Squibb for the last twelve months, we get an operating income of $14,390 million and it would take about three years to repay the debt with operating income, which is acceptable.

So far, the Bristol-Myers Squibb shareholders don't have to fear that the company is running in trouble because of extremely high debt levels, but the shares got diluted by the acquisition, and therefore, it is important that Celgene adds to revenue and cash flow.