Summary

- Two years ago, I published a piece explaining why I didn't like IBM.

- Today, not much has changed.

- While the stock offers a good combination of dividend safety and dividend potential, until I get more clarity on the integration of Red Hat, I will remain on the sidelines.

- However, patient and optimistic investors might want to wait it out since the dividend is attractive, and when/if the business turns around, there will be a lot of value to be unlocked.

- Written by Robert Kovacs

Introduction

Two years ago, I published a piece on International Business Machines (IBM). I didn't like it then, mostly because the inflection point between the segments which were growing and those which were declining hadn't yet been met. Two years later, this is still the case. IBM still needs to follow through on their promise to grab a large chunk of the cloud market. The Red Hat acquisition might turn out to be successful, but until I see it with my own eyes, I remain unconvinced.

Source: IBM

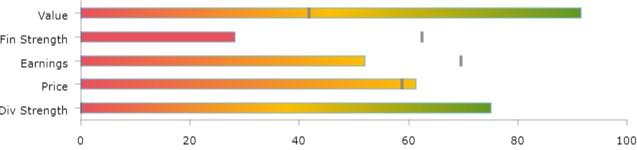

IBM is currently trading at $142.48 and yields 4.55%. My M.A.D Assessment gives IBM a Dividend Strength score of 75 and a Stock Strength score of 66.

I believe that dividend investors should avoid IBM Corporation at current prices.

Source: mad-dividends.com

IBM Corp. is an information technology company, which provides integrated solutions that leverage information technology and knowledge of business processes. It operates through the following segments: Cognitive Solutions, Global Business Services, Technology Services & Cloud Platforms, Systems, and Global Financing.

In this article, I will first consider IBM's potential as an income producing investment before considering its potential for capital appreciation or capital preservation in the case of a recession.