Summary

- Accenture recently reported solid Q4 2019 operating results, but management's revenue guidance was not well received by the market.

- Shares are richly valued, but I believe that the company's growth potential is not fully baked into the stock price.

- I hold a position in Accenture, and I plan to add shares on pullbacks.

- This idea was discussed in more depth with members of my private investing community, Going Long With W.G.. Get started today »

Accenture (ACN) recently reported better-than-expected Q4 2019 earnings, but the stock finished the week under pressure. The broader market volatility is definitely coming into play, but analysts are also concerned about management's disappointing forward revenue guide.

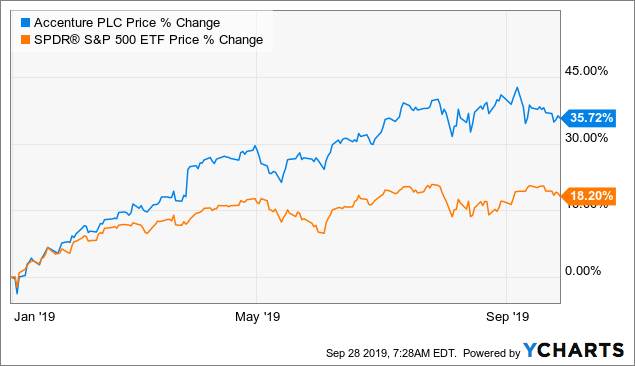

However, let's not forget that ACN's shares are still up big so far in 2019 and outperforming the broader market by almost 18 percentage points.

Data by YCharts

Data by YChartsThere are company-specific risk factors that need to be considered, especially given the broader market uncertainty, but I believe that Accenture's management team has this global IT consulting and outsourcing company well positioned for the future. This unique company has great, long-term business prospects, and in my opinion, Accenture's growth profile should not be overlooked, even after factoring in management's disappointing revenue guidance.

The Q4 2019 Results, A Lot To Like Here

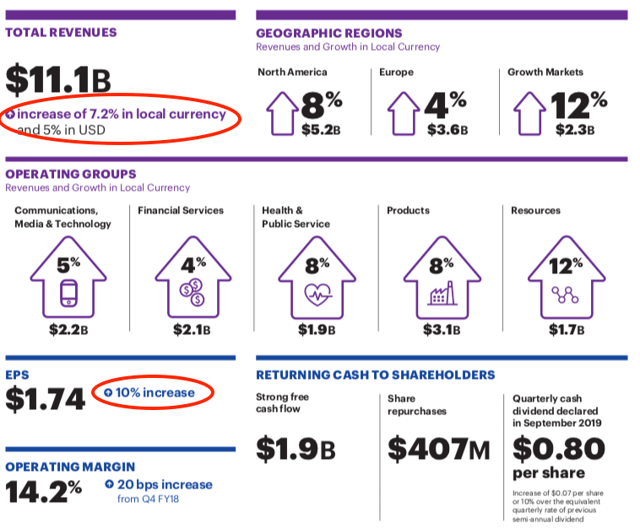

On September 26, 2019, Accenture reported Q4 2019 adjusted EPS of $1.74 (beat by $0.02) on revenue of $11.1B (in line with estimates). These quarterly results also compare favorably to the year-ago quarter.

Source: Q4 2019 Earnings Presentation

Other highlights from the quarter:

- Reported mid-single-digit revenue growth with a double-digit increase in the company's growth markets.

- New bookings were $12.9B, which is a record for the company.

- The operating margin came in at 14.2%, which was a 20bp increase.

- "The New" - Digital, Cloud, Security Services - now accounts for more than 65% of revenues (up from 60% at Q4 2018).

- And the company finally initiated its first quarterly dividend of $0.80 (an increase of 10% from the company's previous semi-annual dividend payment).

There was lot to like about Accenture's Q4 2019 results, but the market struggled to look past management's disappointing forward guidance: