Summary

- There has been much debate whether it is best to hold shares in Celgene or Bristol-Myers.

- Back in July, I made a case for selling Celgene shares and buying Bristol-Myers shares with the proceeds.

- This seems to be a debate where both sides can show positive results. But at the half-way mark, I can say holding Bristol-Myers shares has been the far superior strategy.

- Although solid gains have already been achieved ahead of merger, on balance, continuing to hold shares in Bristol-Myers remains the preferred option.

- This idea was discussed in more depth with members of my private investing community, Analysts Cnr | H2 SuperGrid. Get started today »

Celgene Or Bristol-Myers: Comparing The Two

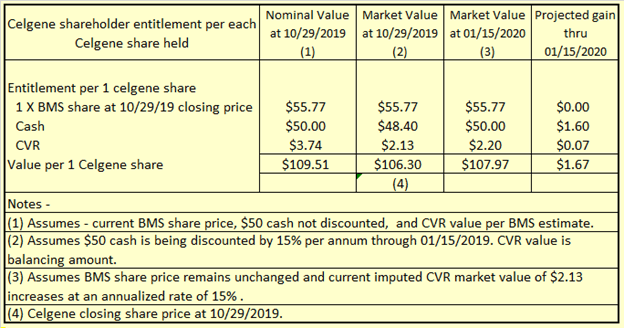

Bristol-Myers Squibb (BMY) have successfully offered to acquire Celgene (CELG), and the transaction is expected to complete in early January 2020. This means a shareholder in Celgene no longer has an interest in the Celgene business, as the business has been conditionally sold to Bristol-Myers Squibb (which I will hereafter abbreviate to "BMS"). A Celgene share entitles the owner to 1 share in BMS plus $50 in cash, plus a Contingent Value Right (CVR) for which BMS has estimated a current fair value of $3.74 (see my article, "Sell Celgene, Buy Bristol-Myers Ahead Of Proposed Merger", for the basis of this estimate). BMS describes the CVR as follows:

Under the terms of our agreement, each Celgene share will receive one tradeable CVR, which will entitle its holder to receive a one-time potential payment of $9.00 in cash upon FDA approval of all three of ozanimod (by December 31, 2020), liso-cel (JCAR017) (by December 31, 2020) and bb2121 (by March 31, 2021), in each case for a specified indication.

TABLE 1 below provides an analysis of the components of the Celgene share price under various scenarios.

TABLE 1

In TABLE 1, I am assuming holding a Celgene share through mid-January 2020, after the sale to BMS is consummated, could conceivably provide a gain of $1.67. This is on the basis the BMS share price remains unchanged, the $50 cash is received, which is a given, and the CVRs are listed on the market and are trading at $2.20. Back in July, I made a case for selling Celgene shares and buying Bristol-Myers shares with the proceeds, based on comparative share prices at that time. Further below, I again compare the potential outcomes of selling Celgene shares and buying the equivalent value of BMS shares, based on the comparative share prices on October 29, 2010. Before I do that, I detail below how my proposal for selling Celgene shares and buying BMS shares back in July has proven to be very profitable for anyone following that course of action.