Summary

- Bristol-Myers expects to close the Celgene acquisition on November 20.

- The merger is immediately 40% accretive to BMY earnings placing 2020 estimates far above $6 per share.

- The stock only trades at 7.5x '21 EPS estimates suggesting investors immediately flip the $50 cash payout into additional BMY shares.

As the merger between Bristol-Myers Squibb (BMY) and Celgene (CELG) approaches the finish line, investors face the surprising dilemma of how to handle Celgene trading at $110 as the merger is a day away from closing. Along with my previous recommendation, investors want to own BMY after the merger as the valuation remains cheap.

Image Source: Celgene website

Last Hurdle

Last Friday, Bristol-Myers confirmed the U.S. Federal Trade Commission accepted the consent order due to the divestment of OTEZLA allowing for the parties to close the Celgene merger. The companies target closing the merger on November 20.

The deal is broken out to 1.0 share of Bristol-Myers and $50.00 in cash for each Celgene share. At an updated Bristol-Myers price of $57.65, the current deal value on closing the merger is $107.65 plus the CVR with a potential value of $9.00.

Celgene actually trades above the price of the stock and cash portion of the deal. Investors are placing a $2-3 value on the CVR. The issue is whether the CVR is worth holding and how investors should convert the $50 cash portion of the deal into BMY shares.

My work will focus on whether to hold BMY shares and how to use the $50 cash while Bram de Haas values the CVR at ~$6.50.

Persistent Value

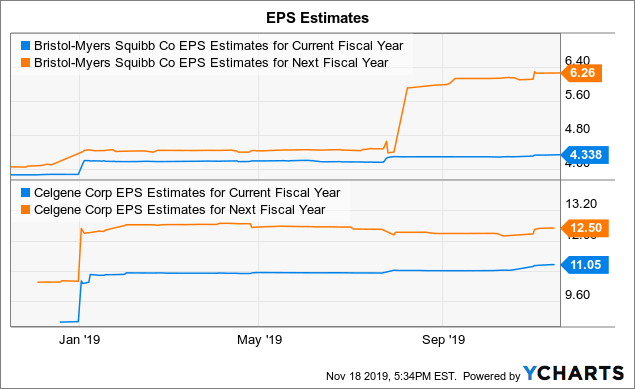

Following a strong Q3, the Bristol-Myers recently raised 2019 EPS guidance to between $4.25 and $4.35. Celgene had a similarly strong quarter beating estimates by $0.28, but the company didn't update 2019 guidance from the previous range of $10.65 to $10.85 due to the pending merger.

The key to the whole deal is that Bristol-Myers forecasts an EPS accretion of greater than 40% in first full year. The previous $4.40 EPS target for 2020 quickly turns into $6.16. Due to the impending merger close, analysts already have hiked the 2020 EPS target to $6.26.

Data by YCharts

Data by YChartsThe 2020 estimate only includes a partial realization of the $2.5 billion in estimated merger synergies. Further, the company estimates $45.0 billion in free cash flow over the next three years that will help reduce interest costs by repaying a large chunk of $45.0 billion in total debt at merger close.