Summary

- Verizon's stock has underperformed the S&P 500 in 2019 by a wide margin.

- The stock is approaching a technical break out at $61.

- Options trades suggest that the stock may surge weeks ahead.

- Looking for a helping hand in the market? Members of Reading The Markets get exclusive ideas and guidance to navigate any climate. Get started today »

Verizon (VZ) has been flirting with a significant technical break out for some time. However, despite these attempts, the stock has failed on multiple occasions. But now, some traders are betting that breakout finally happens and results in the stock rising by 7%.

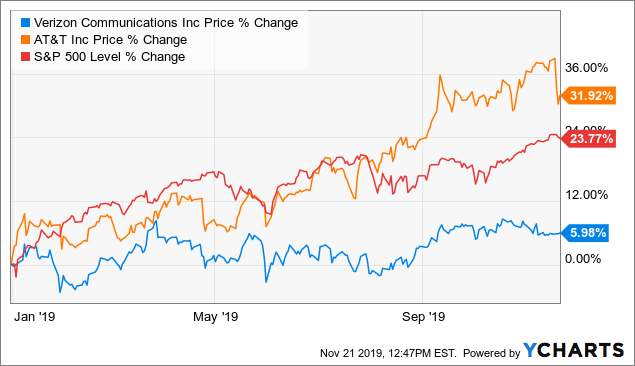

Overall, the stock has not performed all that well in 2019, with shares rising by roughly 6% versus an S&P 500 that has increased 24%. The lack of performance comes, despite the strong performance from peers such as AT&T (T). Additionally, the stock has gotten no boost from the low-interest-rate environment despite the stock's attractive dividend yield of over 4%.

Data by YCharts

Data by YChartsStrong Yield Is Not Helping

The stock's dividend yield is currently trading at a premium to the 10-year Treasury rate, creating a spread of around 2.3%. One reason why the stock has not benefitted from the low-interest-rate environment is that the current yield is trading roughly in-line with its historical spreads since 2014. In fact, since that time, the spread between the rates has been 90 basis points to 3%.

Multiple Expansion?

While the stock isn't likely to get a further boost from its healthy dividend yield, the stock does stand a chance to see earnings multiple expansion. The stock currently trades around 12 times one-year forward earnings. This PE ratio is now in the lower to middle end of its historical range since the beginning of 2016 of 10 to 13.6.