Summary

- Pfizer has been losing patent protection of its star drugs and hence sales have been falling.

- The company is shifting its focus to oncology and getting rid of the baggage of lagging business segments.

- The news of Upjohn-Mylan combination has seen a major fall in Pfizer's stock price.

- This idea was discussed in more depth with members of my private investing community, The Lead-Lag Report. Get started today »

Forget past mistakes. Forget failures. Forget everything except what you're going to do now and do it. - William Durant

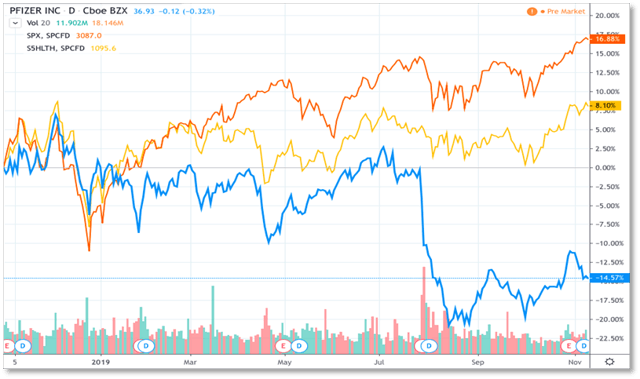

Market movement in last twelve months:

S&P 500: +16.88%

S&P 500 Healthcare: +8.1%

Pfizer: -14.57%

Source: TradingView

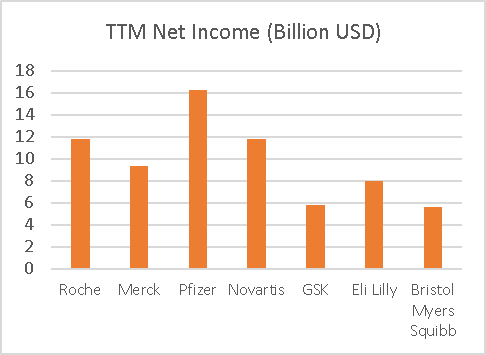

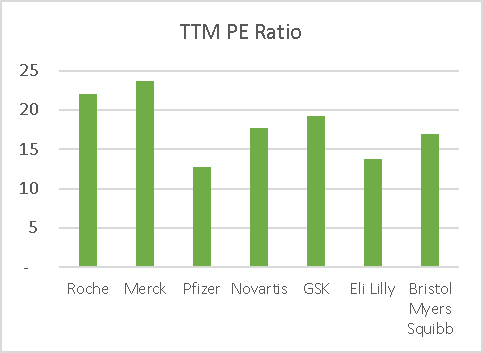

Pfizer (NYSE:PFE) is one of the largest pharmaceutical companies in the world by revenue, commands one of the highest profits in the US Pharma Industry, and yet trades at a lower P/E compared to the rest of the industry.

The company has a steady hand in the prescription drug business, with $10.1 billion in sales last quarter. Pfizer is best known for its blockbusters, Viagra and Lipitor, which were the top-selling drugs last decade and rang up as high as $13 billion in annual sales in 2006.

But things have taken a turn. Lipitor sales have plummeted to $2 billion since the statin lost patent protection in 2011. Viagra sales plunged 75% last year after erectile-dysfunction generics from Teva (NYSE:TEVA) entered the US market in December 2017. These two drugs had made Pfizer the largest drug manufacturer in the world by sales.

Sales for Q3 dropped, which was mainly due to the fall of Pfizer's old off-patent drugs, but it still surpassed analyst estimates, giving a surge of 2.5% in the share price on the day of the announcement. But this is not a green signal for investors to take the plunge.