Summary

- IBM has a long, well-documented track record of underperformance.

- IBM cloud computing segment is barely growing.

- IBM is betting on hybrid cloud computing but is facing significant pressure from Microsoft and Amazon.

- At the same time, IBM is slashing its R&D spending to boost its margins.

I have spent the past few weeks thinking about the sad decline of the International Business Machines (IBM). I have been disappointed with the way a once-storied technology company became a laggard at a time when the world is seeing rapid technological advancements.

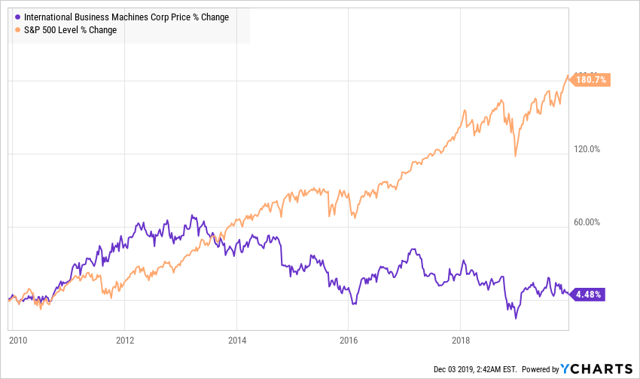

IBM vs. S&P 500 | YCharts

IBM has a long history of underperformance. In the past ten years, IBM's total return has been just 40%. This is minuscule when you compare how other old tech companies have done. Microsoft (MSFT), the crown jewel of technology, has returned 537% while Oracle (ORCL), Intel (INTC), and Cisco (CSCO) have returned 180%, 300%, and, 140% respectively. The S&P 500 has returned more than 200%.

The same trend is visibly clear when you look at the five-year chart. In the past five years, IBM's total return has weakened by 30 basis points while the companies mentioned above have gained by 243%, 42%, 76%, and 87%, respectively.

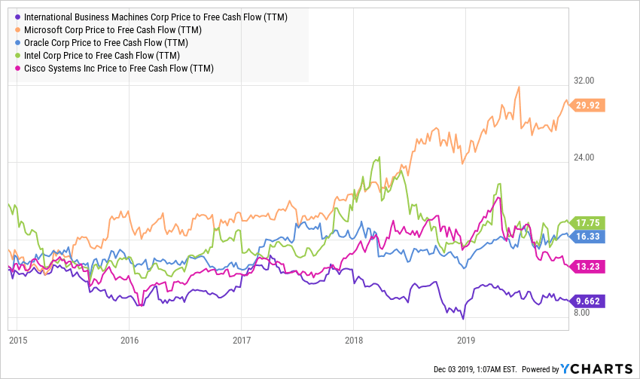

Overall, IBM has underperformed in every metric. This is fully reflected in how the market is valuing the company. The company has a forward PE ratio of 9.9. This is lower than that of Microsoft, Oracle, Intel, and Cisco, which have a forward PE ratio of 23, 13, 12, 13. The same can be seen below when you compare its price to free cash flow.

In other words, IBM is an expensive company to own. Consider this. IBM has a market value of more than $117 billion and an enterprise value of $174 billion. IBM has more than $10 billion in cash and short-term investments and an annual revenue of more than $77 billion. It had a net income of $8.72 billion in 2018. The company has generated more than $12.3 billion in free cash flow in the past 12 months.

Therefore, on the surface, IBM looks like an undervalued company that one would like to have. This changes when you move below the surface and see how far IBM has fallen. For starters, IBM operates in five segments: cloud and cognitive software, Global Technology Services (GTS), Global Business Services (GBS), Systems, and Global Financing.