Summary

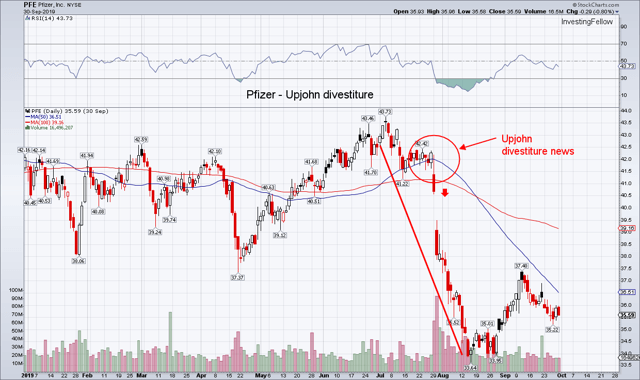

- Pfizer took a huge price drop at the end of July after the company announced the divestment of the Upjohn unit.

- Upjohn unit divesting could bring value to the company in the long term, since a company focused on its core activities is more attractive to investors.

- Pharmaceutical companies that performed unit divestitures in the past had increased their stock price value. (When excellent strategy execution followed the divestiture).

- Above-average Biopharma performance for Q3 2019 is a good signal of small science-based Biopharma strategy execution proposed by management.

Investment Thesis

Following the considerable price drop caused by the announcement of the Upjohn unit divestiture this summer, the market is underestimating Pfizer stock price value. The LOE (Loss of Exclusivity) for some Blockbuster products impacted revenues, but Pfizer is implementing a new strategy focused on innovation and Biopharmaceutical products that will drive profitability in the future.

Upjohn Divestiture

Pfizer (NYSE:PFE) is one of the most important pharmaceutical companies in the world by revenue, with leading products in different therapeutic areas. Its blockbuster products (Viagra, Lyrica, Lipitor) have driven sales for years representing exceptional cash cows products.

In the first six months of 2019, Pfizer suffered decreasing revenues since products in the Upjohn division suffered LOE.At the end of July 2019, Pfizer decided to divest the Upjohn unit of its business to found, a new joint venture company with Mylan (the name is "Viatris"). Mylan will own 43 % of shares, and Pfizer will control 57 % of shares. Viatris will be a player in the generic drug business, and it will merge Upjohn's strong leadership position in emerging markets, with Mylan's significant presence in the occidental markets (the US and Europe).

The primary strategy for Pfizer is to divest non-strategic assets and maintain focus on patented Biopharma drugs and vaccines. However, the divestiture could squeeze more revenues for old drugs thanks to market expansion of the new joint venture company.

It needs to be noted that the divestiture has not been judged positively by the market, and it caused analysts to cut 2019 revenues and EPS estimation for the company, specifically:

- Revenues projections for Pfizer were down from $52 - $54 Bln to $50,5 – $52,5 Bln

- EPS were down from $2,83 - $2,93 to $2,76 - $2,83

Pfizer Upjohn Divestiture - Source: Stockcharts

Pfizer Upjohn Divestiture - Source: Stockcharts