Summary

- Shares of Johnson & Johnson have underperformed, largely because of bad publicity regarding various lawsuits that the company has been fighting.

- The financial strength of Johnson & Johnson gives the company an advantage in legal warfare that will likely see final liabilities amount to less than many are fearing.

- Johnson & Johnson is a wonderful company, and shares are right around fair value by our estimate. Investors can do worse in a market that is so elevated.

Healthcare conglomerate Johnson & Johnson (JNJ) hardly needs much introduction. A maker of various household healthcare products, medical devices and medications, the company is a well-established name in the investment community. With the market at all-time highs as the calendar turns over into 2020, the stock trades at a discount to the market. And while the company continues to face litigation (and eventual liability charges), there aren't many companies as well equipped as Johnson & Johnson to handle them. We find shares to be "fairly valued" at current prices, which means that long-term investors could do worse when so much of the market is trading at elevated multiples.

Johnson & Johnson Is "Cheap" Relative To The Market

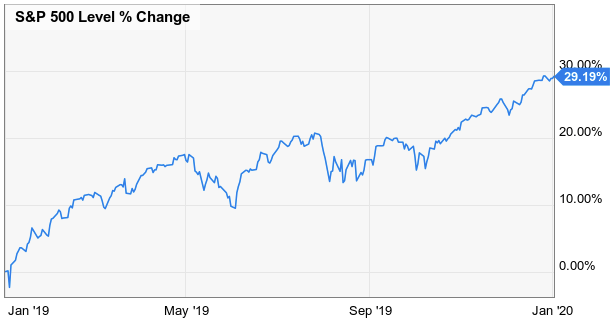

The past year has been an astonishing year for investors. With only occasional dips, the S&P 500 appreciated a whopping 29.19% in 2019. To give some context to this, the historical average return of the S&P 500 going back almost a century is just shy of 10% per annum.

(Source: YCharts)

With the market having a year that falls so far outside of "norms", the appreciation has come at the expense of valuation. As of now, the S&P 500 now trades at more than 24X earnings. This is far higher than the market's historical average of just under 16X.

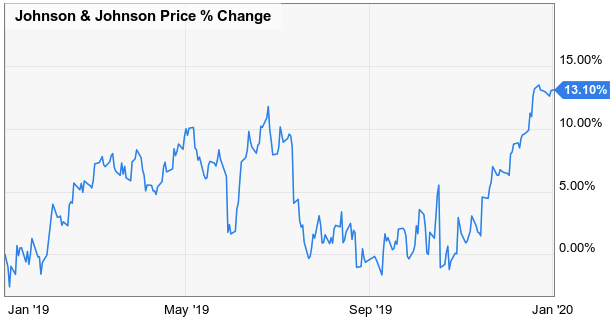

When we look at Johnson & Johnson, it becomes evident that shares have not participated in the overall market rally (although they are still up over the past year and ended 2019 on a strong note).

(Source: YCharts)

Johnson & Johnson is closing out its fiscal year later this month, and with final guidance of between $8.84 and $8.89 (constant currency), the stock is trading at a multiple of approximately 16.45X. This is a sizable 32% discount to the S&P 500 and a 14% discount to Johnson & Johnson's own 10-year median P/E ratio.