Summary

- Teladoc Health agrees to buy InTouch Health for $600 million.

- The virtual care provider raised Q4 revenue estimates to ~$155.5 million.

- The stock isn't cheap anymore at 9x pro-forma '20 revenue estimates.

- This idea was discussed in more depth with members of my private investing community, DIY Value Investing. Get started today »

Before a presentation at the J.P. Morgan Healthcare conference on Monday, Teladoc Health (TDOC) announced the acquisition of InTouch Health for $600 million. After being bullish on the stock earlier last year, the deal is likely going to contribute to the stock rallying above $100 and offer a good time to exit Teladoc with a nearly 75% gain.

Image Source: Teladoc Health website

Deal Details

InTouch Health provides the virtual care leader with a leading provider of enterprise telehealth solutions. The company is a leader in provider-to-provider telemedicine solutions with a partner care network of 450 hospitals and health systems with nearly 15,000 participating physician users globally.

Teladoc Health is paying $600 million to acquire an estimated $80 million revenue stream in 2019. The company is paying $150 million in cash and $450 million in Teladoc shares, or ~5.4 million shares.

The stock currently has a market cap of $6.5 billion after the 10+% gain, providing an updated value assuming no further stock gains in the $7.0 billion range. The deal has a predicted close in Q2.

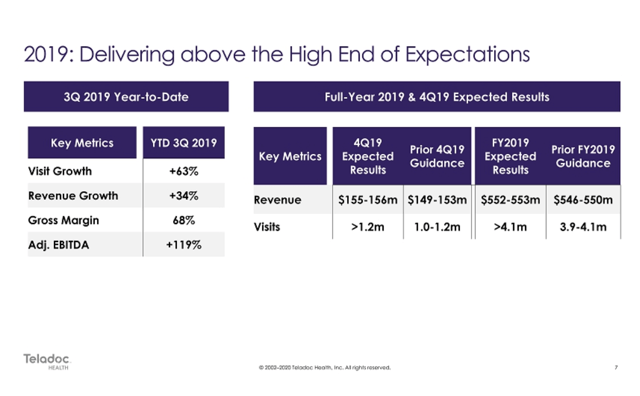

A big key to the stock rally is Teladoc Health updating Q4 numbers. The company now expects revenues of ~$155.5 million versus guidance at ~$151.0 million and patient visits to exceed the high end of previous guidance around 1.2 million visits.

Source: Teladoc Health JPM presentation

High Hopes

The stock has soared to all-time highs on the deal and increased guidance for Q4. Teladoc loses appeal as the stock approaches stretched valuations of 10x revenues in a sign the market is too hyped over the virtual healthcare provider. The company was quickly heading towards 20% revenue growth after Q3 sales growth was only 24%. Such growth wouldn't warrant the stock trading at 10x forward sales estimates.

Source: Seeking Alpha earnings estimates

InTouch Health adds ~$80 million worth of revenue at a 35% growth rate last year. Using 30% growth in 2020, the new acquisition will add $104 million in revenues.