Summary

- The markets are experiencing rarely seen volatility but I think that investors should not lose sight of the big picture.

- According to fundamental parameters, IBM is undervalued by almost 40 percent and thus has correspondingly upside potential.

- However, IBM seems to be underperforming in the current uncertainties. So it could go even further downhill until it gets better.

- In the long term, however, I see annual returns in the double-digit percentage range.

Introduction

While the markets are experiencing rarely seen volatility, investors should not lose sight of the big picture. This is particularly true for long-term investors with an investment horizon of more than ten years. In the long term, the markets and global economies will have overcome the current phase of downturn and uncertainty and will rise again. Therefore, for long-term investors (which I count myself among), there are certainly interesting opportunities to invest their cash or to build up their existing cash flow through further investments.

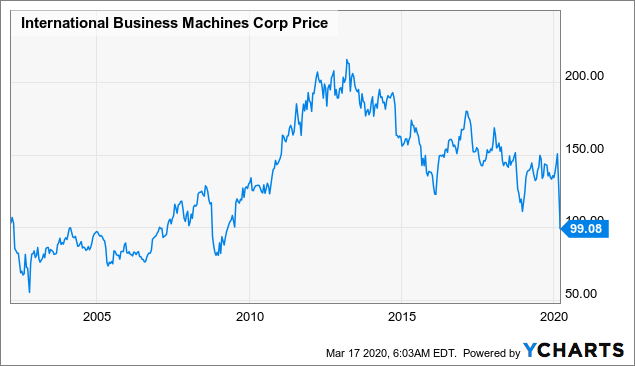

This is also true for IBM (IBM). The company's shares are now traded on the stock exchanges for a double-digit amount. Investors would have to travel back more than ten years to purchase shares for the same amount.

Data by YCharts

Data by YChartsHere, the fundamental outlook is very good. Looking back at the past few weeks, the share prices could nevertheless fall even further before things get better in the long term.

Valuation indicates a huge upside potential

Conversely, IBM is at these price levels extremely cheap. This could attract buyers in the future and support the price somewhat downwards.