Summary

- Against a backdrop of years of declining sales, IBM offers the latest iteration of its technology strategy, Chapter 2, as the path back to increased sales.

- With a potential market opportunity in excess of $1 trillion exploiting trends in AI and hybrid-cloud, the company may be well-positioned to put the business on a new trajectory.

- But, there are numerous, serious threats which may impede the company's ability to recognize their vision.

- Current Coronavirus panic and strategic headwinds make reasonable foresight impossible. But, share levels in the $90s and possibly low $100s may still entice a limited position by some investors.

1.0 Introduction

I want it to work. If it doesn't, the IBM of the future may look quite different from the IBM of today.

The "it" that I refer to above is IBM's current "Chapter 2" technology strategy; a market approach, introduced by Ginni Rometty in the company's Annual Report FY '18, designed to attack - what IBM perceives as - two high-growth trends in enterprise information technology. IBM CFO, Jim Kavanaugh, offered a common talking point about the strategy during the recent Morgan Stanley Technology, Media, and Telecom Conference on March 3, 2020, stating

"...we believe strongly that the next evolution of cloud is going to be centered around a tighter integration of data and AI [artificial intelligence] and hybrid cloud."

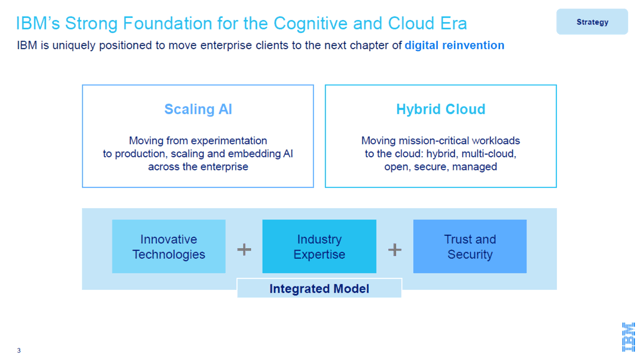

Broadly, IBM considers a future of enterprise-scale artificial intelligence ("AI") applications and hybrid-cloud architectures the next "chapter" in the evolution of information technology. Indeed, IBM predicated its massive $34BB bet on Red Hat on its belief that the aforementioned trends represent a nascent, $1+ trillion market; a market that will, in theory, drive aggregate demand for IBM-Red Hat software technologies, as well as carry significant services opportunities feeding into the company's "all important" multi-billion-dollar Global Business Services ("GBS") and Global Technology Services ("GTS") businesses. (GBS and GTS realized $16.6BB and $27.3BB in sales in FY '19 respectively.)

Figure 1.1 IBM Chapter 2 Strategic Model

Source: IBM Investor Update 2019

Coronavirus effects on the global economy notwithstanding, some IBM bulls may find themselves awash in optimism against a backdrop of frustration. While the company has been shedding non-strategic businesses, IBM cannot explain away its historical top-line performance, which peaked at nearly $107BB in FY '11 but saw an end to FY '19 at just over $77BB, through divestitures. Perhaps Chapter 2 is the pathway back to near-term growth, with the longer-term hope that the company's "moonshot" bets in areas like quantum computing will bear fruit down the road. In regard to the former point, IBM might suggest that Red Hat-specific quarterly revenues in Q4 FY '19 exceeding $1B for the first time and growth of 24% at a normalized rate are direct evidence of the feasibility of that path.