Summary

- ViacomCBS is cheap relative to its peer group.

- ViacomCBS has ample liquidity as they have raised $2.5B in a recent debt offering and, also, possess a $3.5B revolving credit facility.

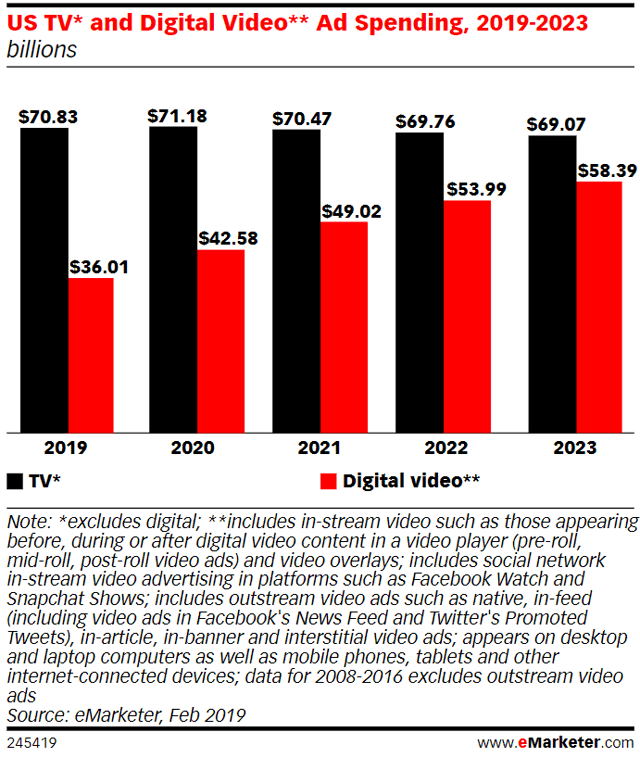

- ViacomCBS is the leader in linear TV and Industry TV advertising revenue has, historically, been relatively stable.

- The combined entity is investing in the Direct to Consumer (DTC) model and is a “freemium” play.

- ViacomCBS has assets to be disposed that can generate proceeds in excess of 20% of its current market capitalization.

The bear case for ViacomCBS (VIAC) is relatively simple -- these two companies united two decades ago only to split in ~2005 to separate the growth asset, which is CBS, from the cash cow, which is Viacom. According to Keryn Redstone:

There was a good reason why they split. The idea that combining them is going to create a better (company). I mean who is it better for? I don’t think it’s better for anyone

Source: CBS-Viacom: 20 Years Later, a Look Back at the High Hopes and Eventual Collapse of That First Merger

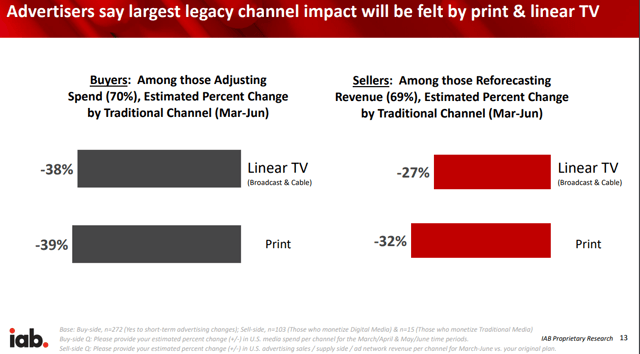

Secondly, the merger of Viacom and CBS created a leader in TV advertising with over 20% share of the market. Someone forget to tell leadership that TV advertising has been relatively flat for a couple of years. Moreover, due to Coronavirus, while user engagement has increased, TV advertising spending is expecting to decrease.

Thirdly, at the time of merger, the combined entity committed to ~$750M in synergies, but bears argue that in a merger of similar companies, one cannot find more than 10% of the combined entity’s SG&A? Surely there are more expense synergies to be found in the combination of two media companies.

Fourthly, ViacomCBS appears to be “caught in the middle” from a strategic sense as the combined entity is an “and” company as they are investing in traditional TV and OTT. According to MoffettNathanson, investors choose companies that pick OTT or Linear TV “with little tolerance for those in the middle.” ViacomCBS: Stuck In The Middle? | Radio & Television Business Report It should, also, be appreciated that Bernstein shares this opinion as well. As a result, this merger was not well received by the market as both former CBS and former Viacom declined. Moreover, when a reporter was having coffee with a media executive, the reporter asked the executive a question regarding the Viacom CBS merger. Rather than responding verbally: