Summary

- Accenture is nearing 52-week highs, but there's still a little room to run until fair value.

- IT Spending is forecast to be on the rise in 2021, and COVID-19 will only accelerate that as digital transformations speed up.

- It's boring, but it's consistent. That's why I'm buying Accenture for my personal portfolio.

While big-name technology companies are already pushing to new 52-week highs, one name still has some space ahead of it. Accenture (ACN), the world's top consultancy firm, stands to benefit from an increase in technology spending, the corporate migration to the cloud, and the soaring remote work landscape.

Image: Accenture Logo

I want to dig into this 'A+' rated Hideaway stock to see if new 52-week highs are in its future.

An Accenture Overview

Accenture is a technology consulting firm with five distinct sectors, each serving companies that operate in those segments: Communications, Media & Technology, Financial Services, Health & Public Service, Products, and Resources.

Across all segments, Accenture consults firms on moves to the cloud, outsourcing, and working with other large-scale providers, like Salesforce (CRM). In an ever-changing technological world, Accenture's services are generally always required; else, a firm would have to hire specialized staff.

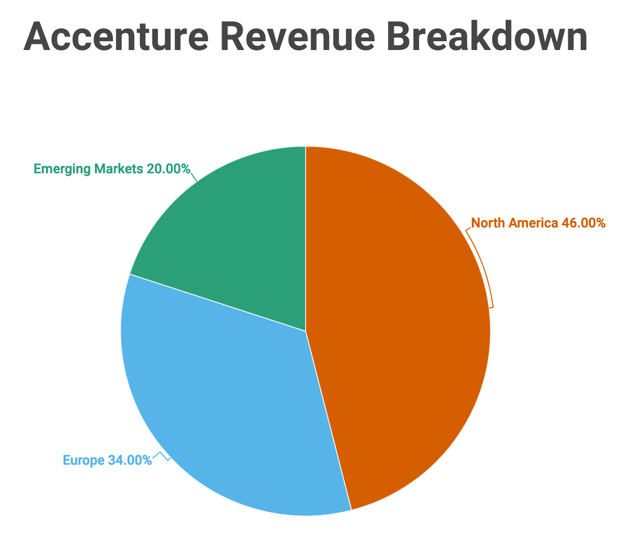

Image: Accenture 2019 revenue breakdown by geography

More than three-quarters of the Fortune 500 can be called Accenture clients. Having this many clients across almost every quantifiable industry allows Accenture to see where the tech marketplace is going, thus allowing Accenture to help all customers get there.

Today, 56% of Accenture's revenues are from consulting services, while the remaining 44% comes from outsourcing. The company is geographically diverse, with 46% of last year's revenues coming from North America, and 34% coming from Europe.

A History Of Growth

Accenture has a history of consistent growth. The company attains this growth by being the largest and most trusted consulting firm in the market. Over time, it has built this position by hiring talented consultants and acquiring firms with specializations in the direction the market is heading.

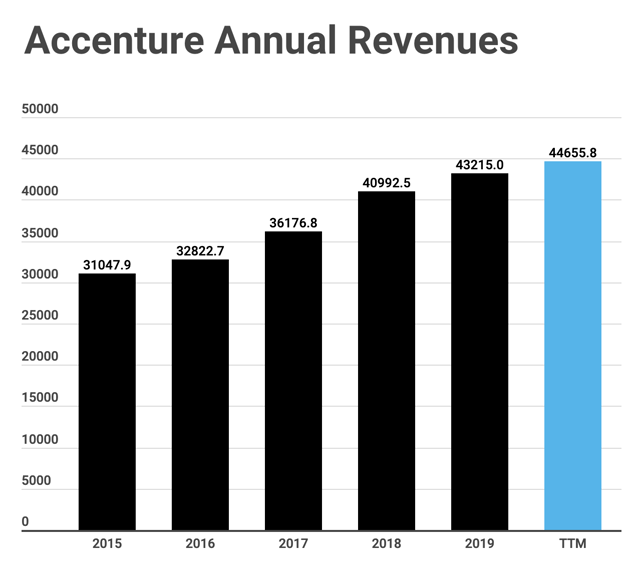

Image: Accenture's Annual Revenues

Over the last five years, Accenture's revenues grew 39.2% to $43.215B in 2019. This is a CAGR of 7.57% over that period. It's not phenomenal, but it's admirable from a $100B+ services firm that relies heavily on employees (i.e., not a SaaS).