Summary

- The Estee Lauder Companies is one of the world's leading manufacturers and marketers of quality skin care, makeup, fragrance, and hair care products.

- The company has a solid balance sheet, bargaining power of its customers and a wide economic moat due to its brand names.

- With an intrinsic value of $160, the stock is still overvalued.

In the last few years, I tried to focus more and more on companies that have a wide economic moat around the business with high barriers to entry. We are also looking for companies that will provide high levels of stability and consistency over several years and decades and which will therefore be a good investment. To find these companies, I screen for different metrics like margin stability, above average return on invested capital and consistently increasing revenue over time. One of the companies matching these criteria is The Estee Lauder Companies (EL), which I will describe in more detail in this article. Estee Lauder reported an average RoIC of 20.76% over the last 10 years, a stable gross margin and slightly increasing operating margin and also stable revenue growth rates.

(Source: Pixabay)

In the following article, I will provide a short overview and try to demonstrate why Estee Lauder is a superior business. Therefore, I will look at different aspects like the wide economic moat, the company's bargaining power, the growth potential of the industry and the company and of course, we will provide an intrinsic value calculation. But we will start with a business description of Estee Lauder.

Business Description

The Estee Lauder Companies Inc. was founded in 1946 by Estee and Joseph Lauder, had its IPO in 1995 and today it is employing almost 50,000 people. It is one of the world's leading manufacturers and marketers of quality skin scare, makeup, fragrance, and hair care products. These products are sold in about 150 countries and territories under a number of well-known brand names. These brand names include Estee Lauder, Aramis, M.A.C, La Mer, Jo Malone London, Aveda and Too Faced. The company has a wide array of brands. On the one hand, the brands can be seen as a mix of classic and progressive brands. And on the other hand, there are brands which rather belong to the premium sector and other brands rather selling for lower prices. Estee Lauder's goal is to address a broad range of preferences and tastes with its different brands.

(Source: Estee Lauder Investor Relations)

Estee Lauder is reporting in four different categories:

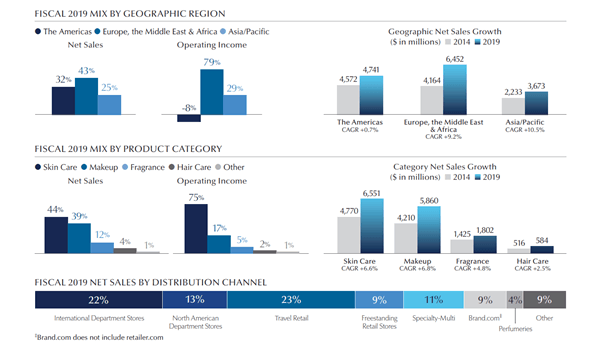

- Skin Care: In 2019, this segment was responsible for 44% of total revenue and includes a broad range of skin care products, that address various skin care. These products include moisturizers, serums, cleansers, toners, body care, exfoliators, acne care and oil correctors, facial masks or sun care products. This segment is not only responsible for the biggest part of revenue, it also had the highest operating margin (29.4% in 2019) and the second-highest CAGR for sales over the last five years (6.6%).

- Makeup: This segment generated 39% of total revenue in 2019. The products of this segment include lipsticks, lip glosses, mascaras, foundations, eyeshadows, nail polishes and powders. Many of the products are offered in an extensive palette of shades and colors. This segment has an operating margin of 7.5% and in the last five years the segment had the highest CAGR of 6.8%.

- Fragrance: This segment was responsible for 12% of total revenue in 2019 and includes many different fragrance products, which are sold in various forms, including eau de parfum spray and colognes, as well as lotions, powders, creams, candles and soaps that are based on a particular fragrance. This segment has an operating margin of 7.8% and a CAGR of 4.8%.

- Hair Care: This segment was responsible for 4% of total revenue in 2019 and the hair care products include shampoos, conditioners, style products, treatment, finishing sprays and hair color products. The segment has the lowest operating margin of the four segments (only 6.7%) and had also the lowest CAGR of all four segments (2.5% CAGR for net sales during the last five years).

(Source: Estee Lauder Investor Relations)

When looking at the different regions, Europe, Middle East and Africa is responsible for 43.4% of total revenue. America is responsible for 31.9% of total revenue and the Asia-Pacific region is responsible for 24.7% of total revenue. During the last few years, the highest growth rates stemmed from the Asia-Pacific region with a CAGR of 10% in the last five years and the EMEA region with a CAGR of almost 12% in the last five years.