Summary

- ViacomCBS has one of the best content libraries in the business.

- The company is carrying an excess of debt, but its liquidity position is adequate.

- Not much has to go right for VIAC to outperform, and I have a $70 price target on the shares with a 3-5 year time horizon.

Looking at ViacomCBS's (VIAC) market capitalization, it would be easy to mistake the size of the company's operations. At ~$14.5B, it's difficult to put into perspective how cheap ViacomCBS is, considering the breadth of its iconic brands. However, consider this. Nikola (NKLA), a company with effectively no revenue, is 57% off of its highs, and is still a larger company today than VIAC, with $30.3B in trailing sales (also 57% off of its highs, strangely enough). It's a crazy market to operate in today, but I see plenty of value for investors willing to look and ignore the noise.

I've passed over VIAC in screens before (pre-merger), but I pulled the trigger and purchased the company recently based on the extreme value that I see in the shares. I base my buy rating on three things: the value inherent in the company's content, reversion to the mean in advertising spend including the return of professional and college sports, and improvements in the company's streaming strategy. Meanwhile, the company is paying a ~4.2% dividend yield with a 25% payout ratio on this year's depressed projected earnings while investors wait for earnings growth to rematerialize.

The Business

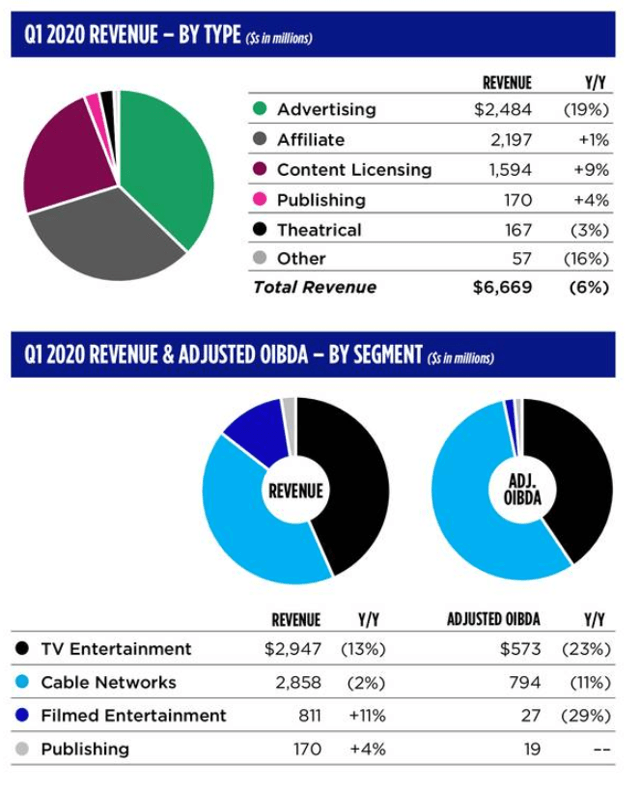

Looking at the pie graphs above, VIAC derives the majority of its revenue from its TV Entertainment and Cable Networks divisions. Cable Networks is then an outsized portion of the operating income for the company (it held up better than TV or filmed entertainment last quarter). The first quarter ended at the end of March, so things will get worse before they get better when the company reports its second quarter.