Summary

- Verizon reported solid Q2 results with $13.6 billion in H1 free cash flow.

- For three years, Verizon has prioritized its balance sheet, and those efforts are largely behind it.

- In coming years, Verizon can use excess cash flow to accelerate dividend growth and repurchase stock.

- As investors realize this inflection point has been reached, shares could break out to $70.

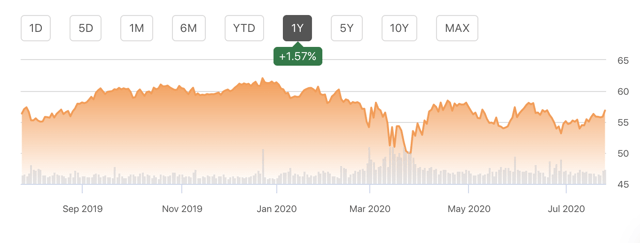

Shares of Verizon (VZ) are roughly unchanged over the past year and have spent much of the past two years stuck in the $50 to $60 zone. While shares have generated little capital gain, VZ has been a steady dividend grower, and shares currently offer a 4.3% yield. Importantly, the company reported solid Q2 results despite COVID-19 headwinds. With steady operating results, improving free cash flow, and a strengthened balance sheet, shares may be set to break out of their range and begin to move higher.

(Source: SEEKING ALPHA)

Q2 Results Were Solid

In the second quarter (financials available here), Verizon earned $1.18, which was $0.03 ahead of consensus on revenue of $30.4 billion—a $400 million beat. EPS was $0.05 lower than a year ago, but interestingly in the company’s press release, management estimated that COVID-19 reduced earnings by about $0.14. Ultimately, it is harder to add new retail customers when stores are closed, and the media unit has advertising sensitivity.

Overall, the company’s core consumer and business units saw revenue fall 4%. Verizon media, a much smaller unit, saw revenue drop more severely, 24%, to $1.4 billion as companies likely froze ad spending in the immediate wake of the pandemic. While advertising revenue is likely to stay subdued given the challenged macro backdrop, there should be some sequential improvement.

On the consumer side, there was less travel, which hurt roaming revenue. And with people spending more time at home, mobile data usage was lower, and VZ waived some fees for COVID impacted customers. These revenue headwinds were manageable and should prove largely transitory. The company did still add 72,000 retail postpaid subscribers, and retail postpaid churn remained a healthy 0.69%. While the consumer market is largely mature, Verizon’s core franchise remains intact with it retaining the vast majority of its existing customers and generating small net additions.

Interestingly, while business revenue was down 3.7%, with small and medium sized businesses down 6.6%, wireless service revenue was up 3.1%. Despite store closures, the company added 280k postpaid wireless connections, 115k ahead of consensus. In a work from home environment, connectivity is more important than ever, especially as some businesses need employees working on secure or recorded lines. VZ would be well positioned to capitalize on any associated increased demand from this trend.