Summary

- I invested a small portion of my portfolio in IBM in February this year.

- I explain why I remain cautiously optimistic in the company's turnaround.

- I also explain why I expect some pain in the near term as the stock targets $115.

In February this year, I wrote an incredibly popular article, explaining why I had invested a small amount of my money in International Business Machines (IBM) after years of criticizing the company. You can read some of my previous articles on the firm here, here, and here.

Since my initial purchase, the stock has fallen by ~15%, while the Nasdaq 100 has grown by ~12.2%. The S&P 500 has fallen by just ~3%, while my main portfolio is up by ~12%. As one of the smallest holdings, IBM's impact on my main portfolio has been relatively muted.

A Wasted Decade

IBM has had a wasted decade. In the past ten years, the company's revenue has fallen from more than $100 billion to under $80 billion in 2019. And, according to analysts, its revenue will drop to $76 billion in 2023. Its net income in this period has dropped from ~$14.8 billion to ~9.4 billion.

Sadly, this slowdown happened at a time of rapid growth in the technology sectors. For example, in the past decade, Microsoft (MSFT) has grown its revenue from ~$69 billion to more than ~143 billion. It has achieved this by being adaptive and putting more efforts in its bid to become the market leader in its industry.

For example, the company launched Microsoft Teams in 2016 in its bid to compete with Slack (WORK). Today, Teams is one of the biggest chat platforms in the world, with more than 75 million daily active users.

IBM has had two main problems in the past decade. First, the management, under Virginia Rometty prioritized shareholder returns at the expense of innovation. A look at its cash flow statement shows that the firm has spent more than $45.2 billion in dividends and more than $75 billion in share buybacks.

In the same period, it has reduced its research and development spending from more than $6 billion to $5.9 billion. Microsoft, on the other hand, has increased its R&D from just $9 billion to near $20 billion in 2019.

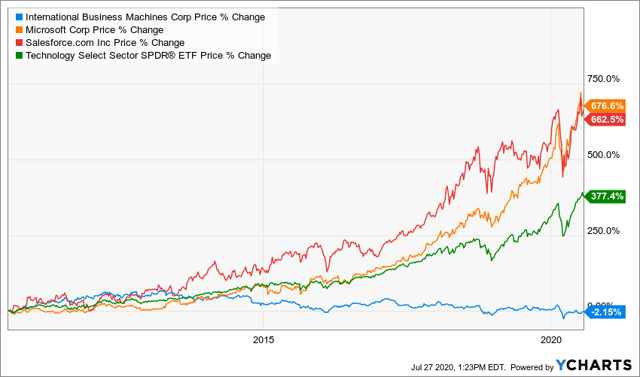

Second, the company missed the shift to cloud computing as Amazon (AMZN) took over. Today, the company's market share is relatively small compared with Amazon and Microsoft. As a result, in the past decade, IBM's stock has fallen by ~2.15%, while the Technology Select Sector has gained by more than 377%.

Why I still remain cautiously bullish on IBM

IBM has some major challenges as it competes with Microsoft, Amazon, Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), and Alibaba (BABA). Its balance sheet is also pretty ugly, with more than $65 billion in long-term and short-term debt, and more than $133 billion in liabilities.

This is against total cash of about $14 billion and total assets of about $154 billion. But, with interest rates so low and the Fed actively buying corporate debt, I believe that the company will not be in distress any time soon. Also, consider that IBM generates tons of cash in free cash flow. In the second quarter alone, it generated more than $2.3 billion in FCF.

IBM also has a small - but growing - market share in the cloud computing industry. In the most recent quarter, the cloud and cognitive software segment grew by 5%, driven by the 30% growth of the cloud and data platforms sub-segment. In comparison, Microsoft's Azure grew by 47%, and I expect that AWS's growth will be above 30%.

To be clear, going by the recent trends, IBM will not catch up to the main rivals. But, at the same time, I expect it to have a reasonable market share in an industry that is estimated to grow in the next few years.