Summary

- Four months ago I finally initiated a position in IBM after refusing to do so for years.

- The dividend is safe, and at the current yield, the stock offers good dividend potential despite the mediocre increase this year.

- However, if you're looking for rapid capital appreciation, you're not going to get it. In 5 years however, you'll be happy you bought IBM.

- Written by Robert Kovacs

Introduction

Back in April, 4 months ago now, I wrote an article which discussed a clear change in direction for myself. After years of turning down an investment in International Business Machines (IBM), I decided that it was time for me to initiate a position.

Since then, IBM has mostly traded sideways, going up 6% from the time of the previous article. IBM is currently trading at

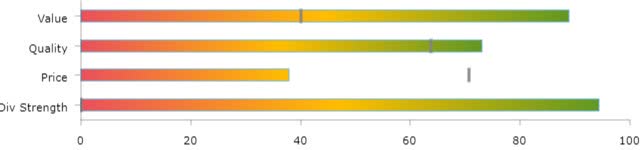

$125.84 and yields 5.18%. Our MAD Scores give IBM a Dividend Strength score of 94 and a Stock Strength score of 80.

Source: mad-dividends.com

IBM’s dividend growth has been slowing in the past few years, I pointed out that this would be the case 3 years ago. This year, the dividend growth rate reached an extremely low rate of only 0.6%.

Does that mean that the days of IBM’s dividend growth are over? Are 1 cent dividend hikes going to become the norm? Do I still believe IBM is a good buy 4 months after purchasing the stock?

These questions will be answered in the following article. As has become customary in articles which Sam & I write, I’ll first go through IBM’s dividend profile before considering its potential for market beating performance in the upcoming twelve months.