Summary

- Q2's most important revenue drivers were up significantly.

- Other key financial metrics improved too.

- IBM is not losing business to competitors, it is losing business to COVID-19.

- IBM just increased their dividend for the 25th year in a row.

- What does IBM CEO Arvind Krishna have in common with AMD CEO Lisa Su?

- Looking for more investing ideas like this one? Get them exclusively at Turnaround Stock Advisory. Get started today »

On June 22, IBM (IBM) reported 2nd quarter 2020 results.

Although revenue fell, there was abundant good news considering the overall economic effects of COVD-19.

The main point to keep in mind is the new direction IBM is headed for under CEO Arvind Krishna. His idea for IBM going forward will take more than 1 or 2 quarters to implement especially after years of rudderless direction under the previous CEO.

I recently wrote an article on IBM's coming resurgence called "IBM: Even Veteran Players Turn Around Eventually."

Here are 5 things when considering an investment in IBM.

1. The most important revenue drivers were up significantly.

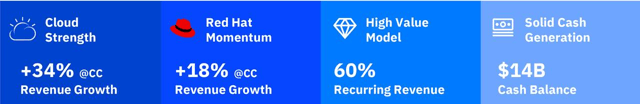

Cloud revenue grew by an impressive 34%. Since the cloud is the avowed direction IBM is heading, this level of increase shows commitment and follow-through.

Also, last year's purchase of Red Hat has shown to be a valuable add-on to current business as well as assuring that future growth will result from the enhanced benefit of having Red Hat services in every nook and cranny of IBM's business. Red Hat revenue increased by 18%, another good sign IBM is on the right track. I have previously written about this deal "No, IBM Did Not Overpay For Red Hat."

2. Other key financial metrics improved too.

Other good financial news was Gross Margin up 2.6% and recurring revenue is now 60% and climbing. Recurring revenue is the direction all software and services IT companies are headed e.g. Microsoft (MSFT) and their conversion of Office from purchase to subscription.

Also, FCF (Free Cash Flow) was $11.5 billion in the last 12 months allowing IBM to pay down almost $7 billion worth of debt (net of cash) in the last 12 months.