Summary

- IBM has not participated in the tech rally.

- IBM increased its dividend for the 25th year in a row. The dividend yield is attractive, exceeding 5% (well above its long-term average).

- IBM is poised for superior performance over the coming years as the dividend is expected to keep on growing.

- The dividend yield is already too high and if the share price continues to remain flattish (or go down), the dividend yield will keep on increasing. How high can it go?

- Over the last 12 months, net cash from operating activities came in at $15.1Bn and free cash flow was $11.5Bn (versus ~$6Bn in total dividends paid).

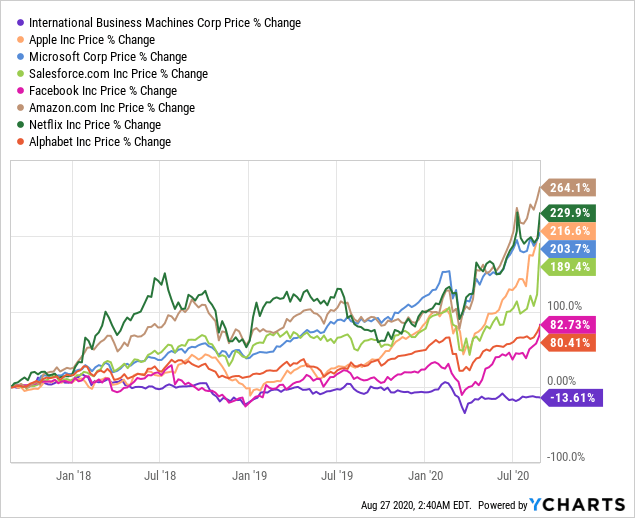

IBM's (IBM) share price has been struggling for many years. It falls under the "old tech guard", massively underperforming the "FANG" stocks, namely: Facebook (FB), Amazon (AMZN), Netflix (NFLX), and Alphabet (GOOG). However, the tech rally extends to many other companies as well including Microsoft (MSFT) and Salesforce (CRM). IBM has been left out. For example, over the past 3 years, all aforementioned companies are up significantly, while IBM is actually down ~13.6%.

Data by YCharts

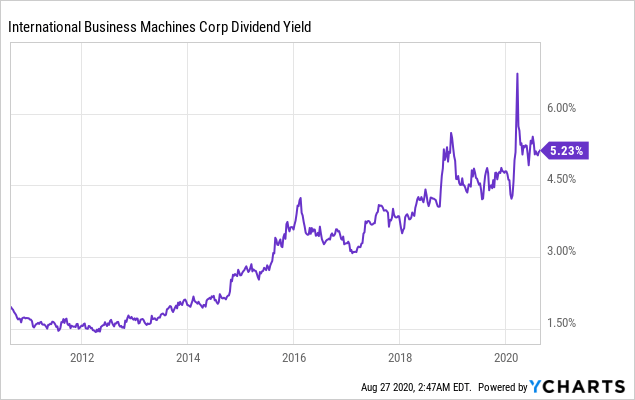

Data by YChartsThat said, IBM increased its dividend for the 25th year in a row and now carries a very attractive dividend yield in excess of 5%, well above its long-term average. Below is a 10-year chart showing the evolution of the dividend yield.

The reason for the increasing dividend yield is simple. The company has raised the dividend each year, while the share price has gone nowhere.