Summary

- IBM is successfully pivoting itself away from its declining legacy products and towards growth as a cloud, software, and services company.

- 60% of IBM’s revenue is recurring, and the Company touts a long-tenured, highly diversified customer base.

- For the first time in over a decade, we expect IBM to return to sustained growth in 2021, driven by a successful business transition.

- Considering IBM’s forecasted growth, thecurrent valuation levels are highly attractive.

- IBM pays a handsome dividend yield of 5.3% and has a 25-year history of increasing its annual dividend.

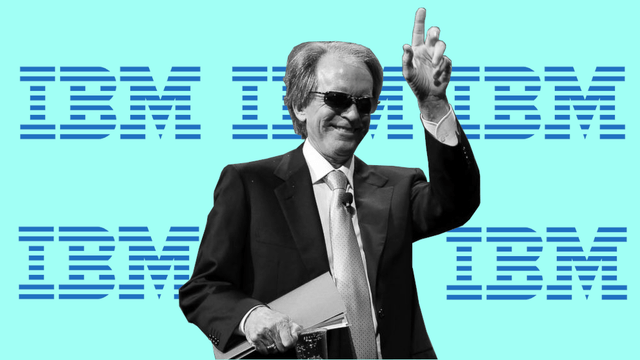

Image: Reuters, Simplivest Graphics

Investment Thesis

In his July 2020 Investment Outlook, Bill Gross recommended IBM as a stock that he likes. Bill Gross is often referred to as the “Bond King” and was a co-founder of PIMCO. He left the firm in a nasty public battle but remains – in our opinion – one of the best minds in the investment industry. When he talks, we listen.

IBM is successfully pivoting itself away from its declining legacy products and towards growth as a cloud, software, and services company. Importantly, IBM’s cloud offerings are in the niche of hybrid cloud and are sufficiently differentiated from public cloud behemoths like Amazon Web Services, Microsoft Azure, and Google Cloud.

60% of IBM’s revenue is recurring, and the Company touts a long-tenured, highly diversified customer base. The company’s project services can be lumpy, though, as evidenced by their decline during the COVID-19 Pandemic.

For the first time in over a decade, we expect IBM to return to sustained growth in 2021, driven by a successful business transition. IBM’s current valuation metrics are in line with its long-term averages, but those averages were of a company in decline. Considering IBM’s forecasted growth, the current valuation levels are highly attractive. What’s more, the Company pays a handsome dividend yield of 5.3% and has a 25-year history of increasing its annual dividend.

Factor 1: Financial Performance

IBM’s organic revenue growth has ranged between 0% and -5.9% since 2016, driven by declines in the Company’s legacy businesses. The Company’s total growth figures are traditionally a 1-2 percentage points higher than the organic growth numbers.