Summary

- IBM met Q3 estimates reduced due to COVID-19 impacts.

- The stock has traded down too much due to fears over weak revenue trends as the excitement over the corporate split has disappeared.

- IBM trades at only 10x reduced EPS targets, with the potential to return to the $14 EPS targets as the economy improves.

- The stock offers a very attractive 5.7% dividend yield now on the dip to $115.

- Looking for more investing ideas like this one? Get them exclusively at Out Fox The Street. Get started today »

Despite pre-announcing Q3 numbers, IBM (NYSE:IBM) still managed to disappoint investors with quarterly results. With the big stock dip following earnings on October 19, IBM has now completely given up all of their gains from the excitement around the split of the tech giant into two companies. My investment thesis remains bullish on the deep value turnaround at the tech giant, especially after the stock has fallen all the way down to $115.

Image Source: IBM website

Cloud Diversion

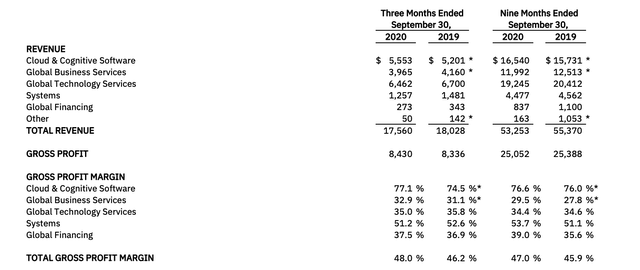

For Q3, IBM saw revenues fall 2.6% YoY to $17.6 billion. While the numbers weren't completely disappointing from the standpoint of the virus impact, the market is still disappointed to see the tech giant slip back into a lengthy period of revenue declines.

One only needs to look at the Q3 results by division to see why IBM wants to split up the company. The Cloud & Cognitive Software division saw revenues up 9%, while the other divisions all saw revenues slip during the quarter. The Systems group is relatively small now at quarterly revenues of only $1.3 billion, but both Global Business and Global Technology groups saw revenues collapse 4% YoY while accounting for total revenue of $10.4 billion.

Source: IBM Q3'20 earnings release

Even with the Cloud & Cognitive Software segment, IBM saw the Cloud business grow 19% YoY, while the Transaction Processing Platform revenues were down 9%, and Cognitive Applications had flat revenues. In essence, Cloud is the only segment growing and holding up the whole business.