Summary

- I can't lie, Netflix came out with some horrible net adds numbers in Q3.

- However, H1 growth was so strong that the Q3 drop off was likely due to a "hangover effect".

- I view the Q3 slowdown as a transitory phenomenon, as Netflix remains a dominant force in its industry.

- Furthermore, based on our growth projections the stock is likely to at least double within the next several (2-5) years.

- This idea was discussed in more depth with members of my private investing community, Albright Investment Group . Get started today »

Oh No, Somebody Save Netflix...

Let's face it. The online streaming giant, and the creator of some of the best original content in the world, Netflix (NFLX) came out with some far worse than expected numbers in Q3.

A quick overview:

EPS: $1.74 vs expected $2.14, a substantial miss of roughly 19%.

Revenue: $6.44 billion vs the expected $6.38 billion, a very slight beat of less than 1%.

Now, here is the number that really counts:

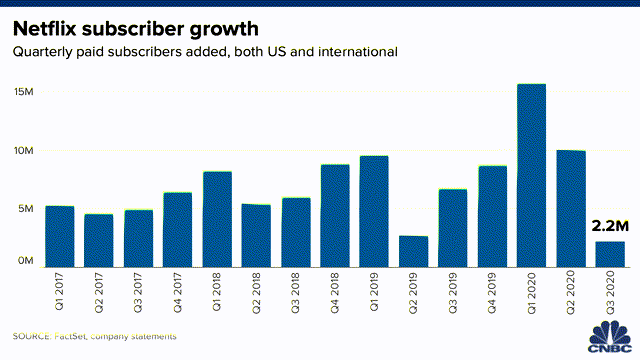

Net adds: Just 2.2 million vs the anticipated 3.57 million global adds, a staggering miss of around 38%.

I have been a user of Netflix since around 2008, when they were mostly sending out DVDs, and were just getting into their streaming business. I've been a very fortunate investor in NFLX since around 2011. I've written numerous bullish articles on Netflix, and I even did an interview on a financial program a while back when the stock was trading at around $188. However, in all of my years of covering this stock I do not remember seeing a subscriber miss quite as large as this one.

As we can clearly see in the chart above, Netflix has not had a quarter with such poor QoQ subscriber growth since at least the start of 2017. Furthermore, after sifting through some data I found that this was the lowest QoQ growth quarter that Netflix has had since Q2 2014.