Summary

- IBM's Q3 sales declined despite the continued promises of an organic and inorganic growth trajectory.

- New CEO talks up M&A deals, but CFO immediately shot down that idea.

- Financial leverage remained elevated at 4.2x.

- My conservative $6.63 EPS estimate is substantially beneath Wall Street's $11.63 EPS for next year.

- Shares still appear overvalued, avoid IBM.

International Business Machines (IBM) reported another disappointing quarter with revenue declining once again, this time down 2.6% against Q3 2019. Meanwhile, pre-tax margins slightly increased from 8.4% to 10.4%, although about three-fourths of that improvement came from further cost eliminations to SG&A, mostly likely coming from continued headcount reduction, and R&D expense cuts rather than pricing power and cross-selling of products and services. The one green shoot for IBM was that Red Hat continued to post exceptional growth (~16%), albeit still accounting for <5% of the top line.

Recent Developments

One interesting pivot was that management announced the spin-off of its Management Infrastructure Services, a part of the company's Global Technology Services operating segment. This division is one of IBM's worst performers given its persistent revenue declines. Upon separation, management anticipates moderate sales growth going forward:

All of this will contribute to accelerated growth for our company in the future and we expect to deliver sustainable mid-single-digit revenue growth upon completion of the separation of NewCo."

Removing this business from consolidated operating results will definitely paint a rosier picture for both the top and bottom line. Furthermore, there's a high likelihood that IBM management will offload a significant amount of its liabilities into this NewCo, specifically debt unrelated to its finance arm, for the sake of benefitting its balance sheet. This transaction would be a leveraged recapitalization, whereby the spin-off is loaded up with debt and the proceeds are absorbed by the parent entity. For that reason, the spinoff could actually represent a nice boon, offsetting the excessive debt financing which stemmed from the Red Hat acquisition.

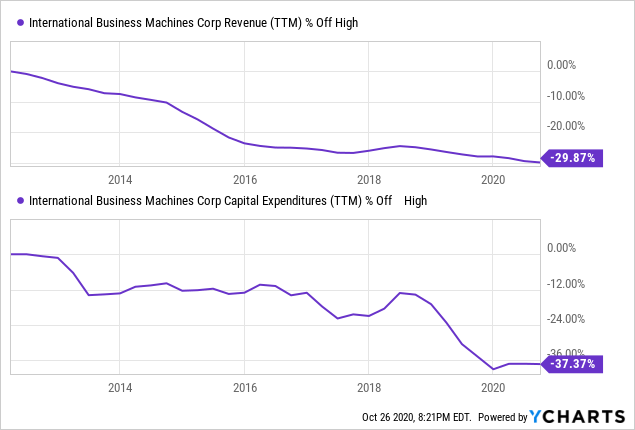

That being said, it's hard to say whether that will be enough. History is certainly in favor of the bears on the top line. For eight consecutive years, IBM's business has suffered on revenue and capital investment:

Data by YCharts

Data by YCharts