Summary

- The Fed will release the second-round CCAR tests in December.

- Will the large banks be allowed to resume buybacks?

- This is a massive catalyst for Citigroup as it is trading at a mere 0.6x tangible book.

- Longer-term Citi should be able to reduce the share count by as much as 50 percent.

The Fed's annual stress tests known as CCAR are getting a repeat screening in December. Normally, these are run once annually and published in late June but this time is different due to the pandemic. The Fed is expected to release these mid-cycle CCAR results sometime in December.

The Fed didn't clarify how the upcoming CCAR cycle will be used. The obvious inference is that it will be determinative in whether to allow banks to resume buybacks, possibly as early as Q1 2021. However, there are a number of uncertainties and chiefly amongst these is the trajectory of the pandemic and economy. Stating the obvious, if macroeconomic conditions materially deteriorate, there won't be share buybacks on the horizon.

Make no mistake about it. The CCAR stress-tests are absolutely crucial for large U.S. banks as they effectively determine the amount of dividends and buybacks the banks can return to investors.

For bank investors, dividends and buyback are immensely important. In recent times, the large U.S. banks typically returned ~100 percent of their earnings or more. I cannot really emphasize enough how important this is for the investment case in banks.

For Citigroup (C) it is even more pronounced given that it is trading at much lower multiples of tangible book value than peers. Currently, Citi trades at a mere 0.6x tangible book. Now if one conservatively assumes that Citi can generate a double-digit return on tangible equity in the medium term (Citi generated 12 percent RoTCE in 2019), then buying back shares at 0.6x is amazingly accretive.

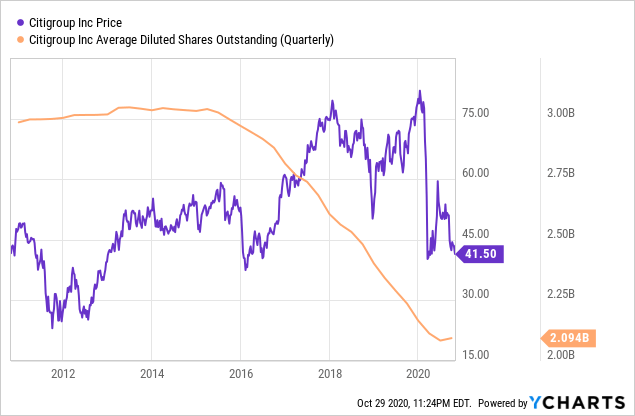

This indeed has been Citigroup's playbook for the last 5 years or so. As you can see from the below chart, the share count reduced from ~3.2 billion to 2.1 billion.

The correlation with the share price is also apparent. As soon as buybacks started around 2015, the share price directionally followed suit.

Important to note that buybacks represent excess capital held by Citi and do not materially impact top-line revenue or earnings.