Summary

- KKR's stock has appreciated nicely so far this year, and strong business performance has the company poised for more gains.

- Book value is a solid pillar of value, is growing, and should continue to grow.

- Earnings growth is supported by a number of sustainable or accelerating trends.

- Put it together and KKR is poised for more gains.

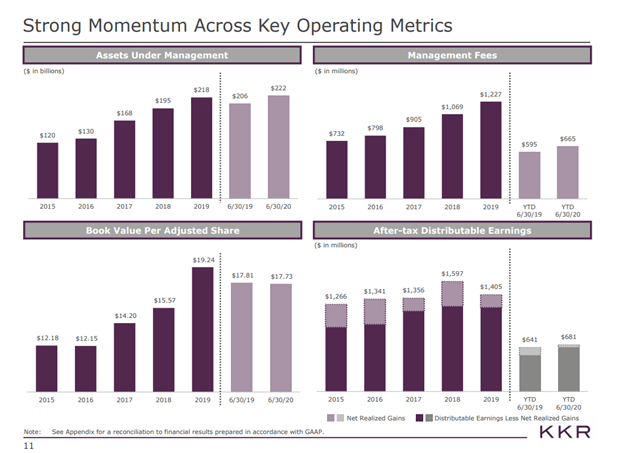

KKR (NYSE:KKR) reported Q3 earnings on October 30th and continues to perform well. Book value was up 14% in the quarter and is now a positive 5% YTD and 11% over the last 12 months. Management fees are also on the rise and are 13% higher than in Q3 of 2019. This steady growth should continue as KKR is looking at a record year of fundraising and deployment. Additionally, it recently announced a transaction with Global Atlantic that will serve as a catalyst for continued growth. KKR has been a good performer this year with the stock price advancing 17% through the end of October. The company's continued strong performance will support future gains.

September 2020 Investor Presentation

Growing Book Value

Unlike some of its alternative asset manager peers, KKR has a large balance sheet. In 2016, the company decided that instead of distributing most of its earnings, it would retain more of its earnings in its various funds alongside its fund investors. This is in contrast to many of its peers, such as Apollo (NYSE:APO) or Blackstone (NYSE:BX), which pay out the bulk of their earnings in dividends and carry a much smaller balance sheet. KKR's balance sheet approach is more similar to that of Brookfield Asset Management (NYSE:BAM).

At the end of Q3, book value stood at $20.26/share, more than half of KKR's current share price. There are legitimate arguments over whether it is better to have an asset-light balance sheet like APO or BX or a more robust balance sheet such as KKR. However, if you choose to accumulate a large book value like KKR has, it is indisputable that the robustness and growth of the book value is important.

KKR's book value/share has been steadily rising since KKR decided to grow its balance sheet. Book value stood at $12.15/share at the end of 2016 and has grown 66% to reach the current level of $20.26/share. In comparison, the S&P 500 was up roughly 50% in the same time frame. KKR's funds have historically achieved impressive returns and are highly sought after. Fund investors include sophisticated parties such as pensions, endowments, sovereign wealth funds and high-net-worth individuals. In the third quarter alone, these investors entrusted KKR with over $8B of capital. KKR's own capital should be well taken care of, and I expect the book value to continue to increase at a nice rate.