Summary

- How have other tech spin-offs performed?

- How might the spin-off benefit IBM itself?

- What's left after the spin-off is the sexy stuff, cloud, AI, and Redhat.

- This deal should ensure the dividend increases going forward.

- Looking for more investing ideas like this one? Get them exclusively at Turnaround Stock Advisory. Get started today »

IBM (IBM) is one of the most written about stocks on Seeking Alpha. There are at least as many detractors as there are supporters.

IBM (IBM) is one of the most written about stocks on Seeking Alpha. There are at least as many detractors as there are supporters.

I have been a supporter for longer than I care to admit, but I'm convinced that under new leadership, they are finally going in the right direction - up.

I recently have written articles on IBM explaining my position "IBM: There's A New Sheriff In Town" and "IBM: Even Veteran Players Turn Around Eventually".

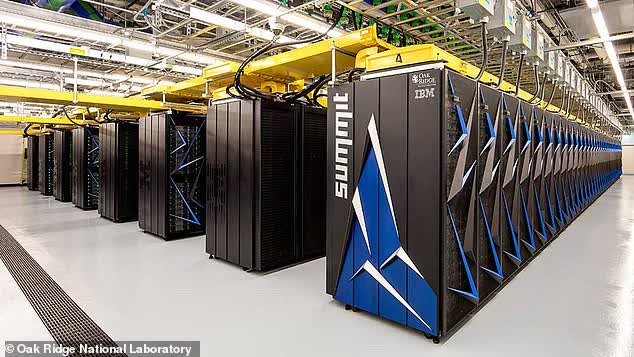

Recent news at IBM includes the spin-off of the Managed Infrastructure Services unit of its Global Technology Services operation into a new public company (closing late 2021) and the most recent earnings report for the third quarter 2020.

Here are four items to consider when looking at IBM's spin-off.

1. How have other tech spin-offs performed?

This is not the first spin off from what I call an old-tech company. There have been many others before. Here are three that may be indicative of what IBM shareholders can expect.

In 2015, HP Inc. (HPQ) spun-off of HP Enterprises (HPE) in this case separating the hardware business from the service business not unlike what IBM is attempting. In this case, the spin-off did a little better at the one-year mark but not a whole lot of difference. In fact, you would have to get to the pandemic to see any meaningful difference.

Then interestingly enough, HPE spun-off DXC Technology (DXC) in 2017. After about one year they were neck and neck but after that began to separate with DXC dropping more than HPE.