Summary

- Teladoc reported outstanding Q3’20 results. This marks the last quarter as a standalone company.

- The margin of safety for investment is high as even without considering potential synergies the combined result with Livongo shows a huge upside.

- The reality is that Teladoc and Livongo are a match made in heaven for all stakeholders.

- Their TAM will be expanded by adding new products, clinical diagnosis, expanding to new distribution channels, and internationally.

But what’s even more interesting are the opportunities to go D2C and to create a new insurance product. Eventually, they could be the primary care provider, the first point of contact for people in need of healthcare.

Investment thesis

Teladoc Health (TDOC) reported outstanding Q3’20 results. This marks the last quarter for Teladoc as a standalone company that primarily focused on acute health conditions. We were bullish about the company pre-merger. However, we are even more excited to witness how Teladoc, together with Livongo (LVGO), will shape the future of virtual health and the endless possibilities they will create thanks to their combined strengths.

For some background on the merger, please refer to our previous article, published on Aug 24th. This report aims to demonstrate why the merger of Teladoc and Livongo is a no-brainer. To do this, we will first look at how far Teladoc has come since its IPO, analyze its latest results, and draw a base case by presenting the combined Q3 results of the two companies without considering any synergy.

We will then focus on how the future of virtual health can potentially look like a post-Teladoc-Livongo merger. We expect the merger will be a success. This will be made possible by Teladoc’s strong track record of successful integration and Livongo’s differentiated offerings. The risk of execution will be minimal because the motivation for convenience and lower healthcare costs is strong for all stakeholders.

Teladoc’s achievement from IPO celebrated

Teladoc and Livongo’s merger was completed just under three months since it was first announced. It marks a new era for Teladoc Health. Thus, it is only right that we take this opportunity to appreciate how this little known Texan telemedicine company, which turned into a $1bn ‘unicorn’ after its IPO in 2015, is now a telemedicine giant.

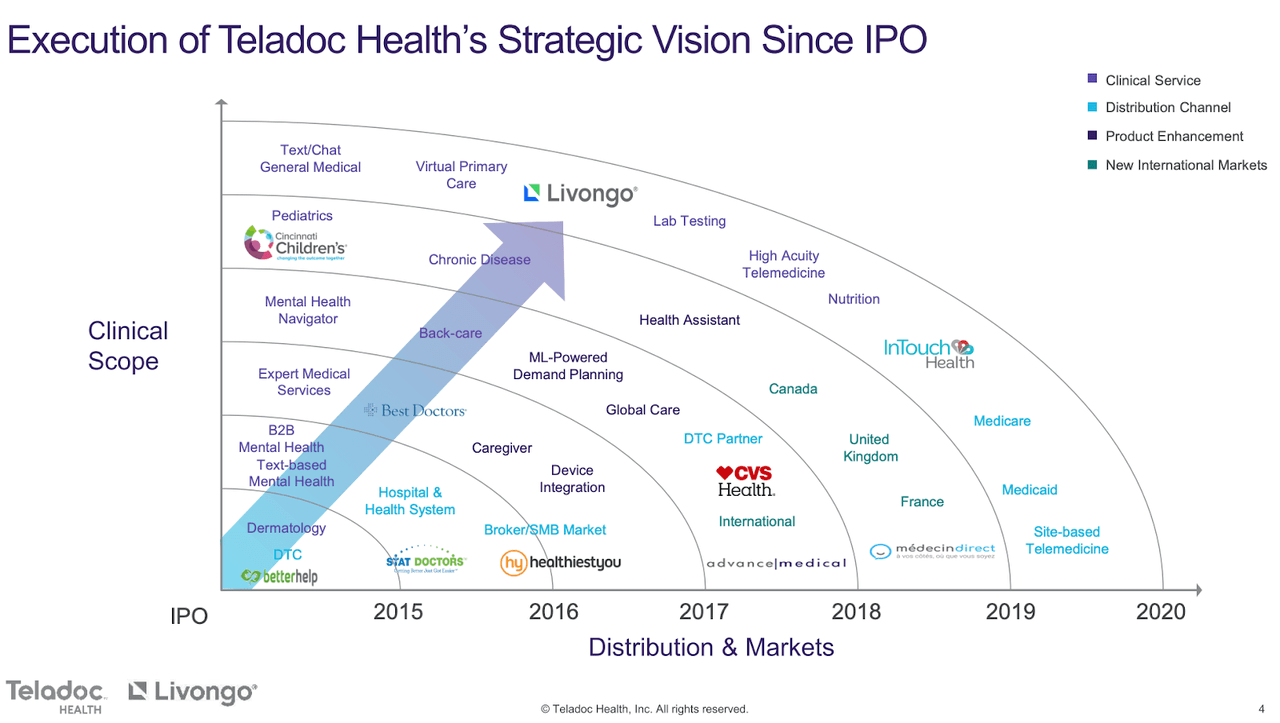

Source: Investor presentation September 2020

Teladoc proclaimed itself as the first telemedicine company in the US. And, to become the largest, it acquired its competitors. As you can see from the slide above, even while preparing for the IPO, it was busy acquiring BetterHelp ($3.5M), then StatDoctors ($30M). Livongo is the largest deal (to date), and to us, it will be the one that will help position Teladoc as the undisputed leader in virtual healthcare for decades.