Summary

- Mastercard released its latest volume data for the last 4 weeks on Tuesday night, showing “relatively steady” trends from Q3 2020.

- Global volumes remained about 3% higher year on year so far in November, despite the resumption of COVID-19 restrictions in key markets.

- Cross-border volume has stayed at the same level as Q3, due to continuing travel restrictions, except in low-margin intra-Europe volume.

- We expect EBIT will show a 25% year-on-year decline in Q4, but the end of COVID-19 is now in sight, and travel is expected to recover in H2 2021.

- At $342.39, Mastercard shares can deliver a total return of 36% (10.0% annualised) in just over 3 years. We re-iterate our Buy rating.

Introduction

We review our investment case on Mastercard (MA) based on the latest volume data released on Tuesday night (November 24) and other developments since our last update in September.

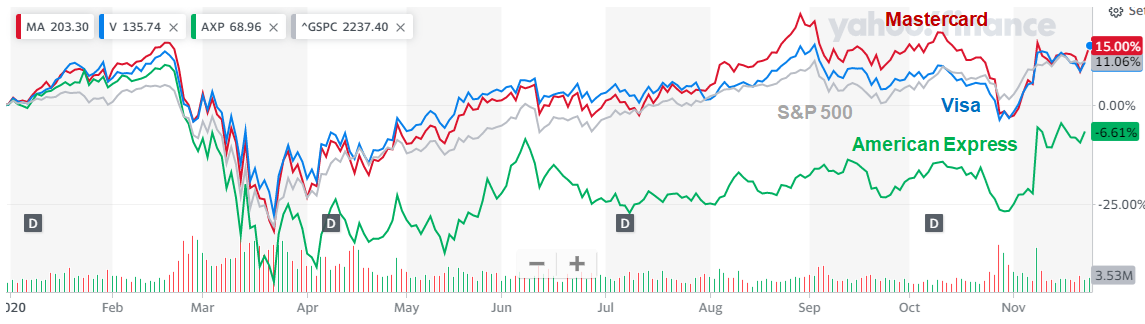

Since we initiated our coverage with a Buy rating in March 2019, MA shares have returned 46.5% (including dividends). During 2020 year to date, MA shares have returned 15.2%, outperforming the S&P 500 index, was far ahead of "value" play American Express (AXP) but was behind PayPal (PYPL) (whose shares have risen around 90%):

Mastercard, Visa & American Express Share Price vs. S&P 500 (2020 YTD) NB. PayPal not shown in chart. Source: Yahoo Finance (25-November-20). NB. PayPal not shown in chart. Source: Yahoo Finance (25-November-20). |

The move to digital payments is a strong secular trend, and we also have Buy ratings on Visa (V) and PayPal and enjoyed strong gains there; we have been Neutral on American Express, which underperformed as expected.

Steady Volume Trends in November

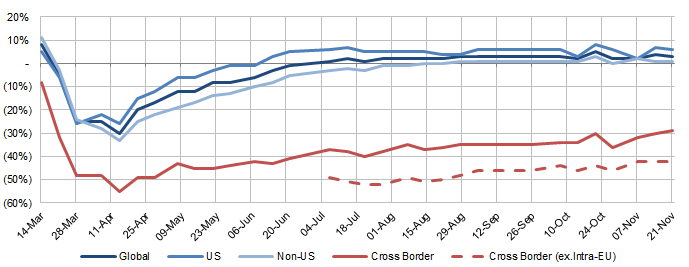

MA's year-on-year volume growth, including for the last 4 weeks (up to the week ending November 21), is shown below:

MA Switched Volume Growth Y/Y (Constant Currency) (Since March 20) NB1. Figure for w/e 14 March is for 2 weeks; no separate data for w/e 28 June. Only September full-month figures available; assume flat trend through the month. NB1. Figure for w/e 14 March is for 2 weeks; no separate data for w/e 28 June. Only September full-month figures available; assume flat trend through the month.Source: MA company filings. |

MA's global volume in the last 4 weeks was "relatively steady", averaging a year-on-year growth of about 3% across this period. (The spike in the week ending October 21 was due to "significant promotional activity by an e-commerce merchant and its competitors", likely Amazon Prime Day on October 13-14).

U.S. volume growth was higher, averaging mid-single-digits, with "some recent strength" in U.S. holiday spend, while non-U.S. volume growth has averaged about 1%, with a "slight decrease" in European Travel & Entertainment ("T&E") and retail due to COVID-19 restrictions having been reintroduced in several key markets, including the U.K., France, and Spain from late October onwards.