Summary

- Citigroup has popped after months in the doldrums.

- The pure value play is still available: cheap 'normalized' P/E and nice peer-relative comps out in 2022.

- Revenue has stood with the best in 2020.

- Risks to your buy case center on the recovery of net interest margin, but it should move in the right direction reasonably soon.

- I have increased my position in C.

Citigroup (C) is the most attractive large bank stock in the US. I am long the stock and have added to the position.

In September I wrote a couple of articles based around the idea that C could double. The stock is up 18% since the first of these, and the thesis remains intact. Investors can happily add here.

Top down, we have had good news.

The major question all investors have to answer at some point lies in front of us - namely whether inflation after the COVID-19 crisis has passed will be higher or lower than in the previous cycle. For banks this will determine interest margins, cost bases and how may impact how they sell their products.

Still, news flow has been reasonably good. Progress around coronavirus vaccines and a modest improvement in market interest rates have helped C start its recovery.

Source: Marketwatch

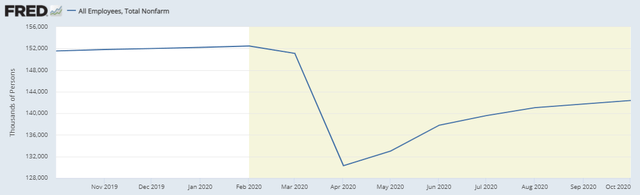

And payrolls data has confirmed the economy continues to recover, despite the uncertainties that persist.

Source: St. Louis Fed

Although the ramp up in government debt has been alarming, and is pretty much a global concern now, I continue to think economies can snap back reasonably well when the recovery comes due to the supportive actions taken by governments and the soundness shown by the banking system in combination with this.