Summary

- Pfizer has been working on New Pfizer for almost a decade. The spin offs of Consumer Health and Upjohn appear to be the last steps.

- Continuation of the policy of dividend growth is a stated priority.

- Biopharma led by scientific pipeline innovation is expected to generate $15 billion in new product revenue through 2025.

- Gene therapies led by three late-stage programs have favorable approval probability and are followed by 10 preclinic programs.

- Pfizer is scheduled to provide an update on their three late-stage gene therapy programs at ASH in December which could be a price catalyst.

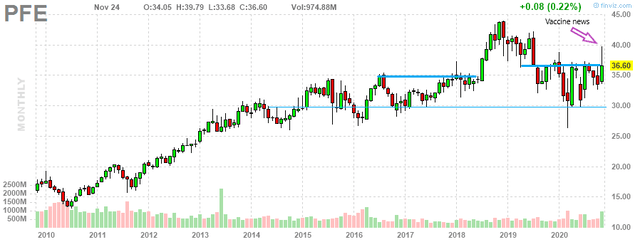

Source: Finviz

“With the separation of Consumer Health last year and the expected separation of Upjohn later this year, we are significantly transforming our company. We are evolving from a diversified enterprise to a more focused and innovative biopharma company, from a scientific fast follower to a first-in-class scientific powerhouse. The transformation of this magnitude (began in 2010) could not happen within 1 or 2 years. The increased R&D productivity, as well as the depth and breadth of our pipeline, gave us the confidence to move so quickly over the past year to transform into the new Pfizer.

Albert Bourla Pfizer 2020 R&D Day

Pfizer (PFE) has a storied history dating back to its founding in 1849. Businesses do not thrive for over 170 years without redefining themselves, which is what Pfizer has done. The latest chapter was written in November when they spun off the Upjohn franchise. This followed the Consumer Health spin out with GlaxoSmithKline (GSK) in 2018 which cleared the way for a New Pfizer era of biopharma innovation.

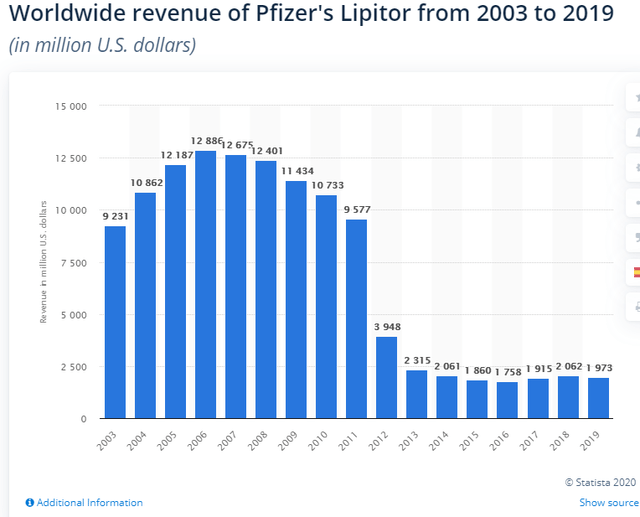

Pfizer stock has established a base over the past few years while the market cap of $200 billion remained at the 2006 level. Competition-prompted by patent expirations-will have that effect. Remember Lipitor? It provided an average of $11 billion annually in the nine years ended in 2011, contributing 25% of Pfizer revenues. Last year the LDL drug generated a respectable $2 billion-still 20% of Upjohn. How about Viagra? Similar cycle. Same result.

Pfizer is projecting average revenue growth of at least 6% through 2025, though much of that growth is back-end loaded. The good news is that you could generate 10% annually on your investment while you wait for the pipeline to produce these results.