Summary

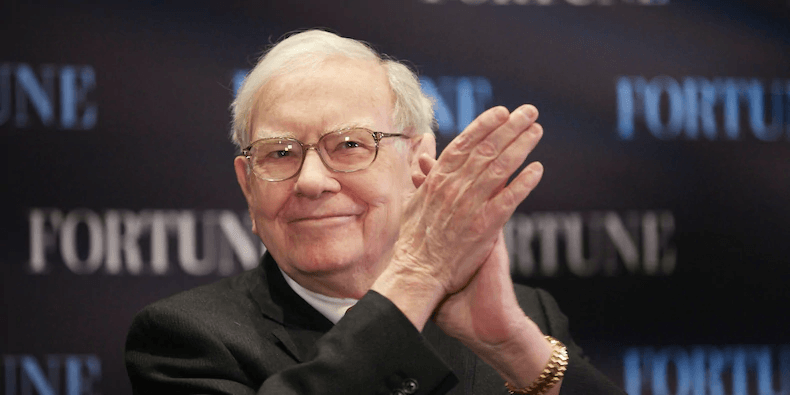

- Berkshire's latest filing revealed the Oracle of Omaha and his team opening new positions in four pharma giants as of late.

- From a quality standpoint, all companies seem like a natural fit considering Buffett's reported preference for wide-moat businesses.

- Two of the four companies do seem to offer a compelling entry opportunity with double-digit total returns likely in the cards going forward.

- Written by the FALCON Team

Introduction

Following the recent news of Warren Buffett's Berkshire Hathaway (BRK.B) (BRK.A) initiating positions worth more than $1.8 billion in each of AbbVie (ABBV), Bristol-Myers Squibb (BMY), and Merck (MRK), as well as $136 million in Pfizer (PFE), we believe it is worthwhile to give our take on the purchases through the established EVA framework. Simply put, EVA (Economic Value Added) is an estimate of a firm's true economic profit, that is computed as net operating profit after taxes (NOPAT) less a charge for tying up balance sheet capital.

While mindlessly mimicking legendary investors' moves could lead to sobering results in general, they could certainly serve as sources of interesting investment ideas. As Berkshire's recent pharma purchase spree most certainly represents a sector bet (analog to taking stakes in four major airlines previously, which were sold eventually), it makes sense to take a look at the stocks individually. For a deep-dive analysis, you can browse through our previous articles on Pfizer and Bristol-Myers, whereas today we rather focus on the valuation aspect and expected total return profile of each pharma giant.

Quality Snapshot

Value Creation: Is a wide-moat rating warranted?

We tend to prefer companies whose businesses are protected by large and enduring economic moats, as buying those companies at the right price generally leads to outperformance, as outlined in our research article. The existence of a moat around a business reportedly plays a key role among Buffett's investment principles as well, citing that "the most important factor to pick a successful investment is judging the durability of a company's competitive advantage".

From a qualitative standpoint, "big pharma" seems like a natural fit, since a diversified portfolio of patent-protected drugs bears strong pricing-power, enabling these businesses to generate returns on invested capital in excess of their cost of capital. The lengthy patent cycles also allow for sufficient time to bring the next generation of pharmaceuticals to the market, while the established product lines produce a sufficient amount of cash flow to fund the immense costs of drug development (averaging ~$1B per new medicine). Additionally, the sheer size of these companies enables an efficient distribution channel and massive economies of scale in drug manufacturing, underpinning the wide-moat qualitative thesis by allowing these businesses to retain their competitive position and outearn their WACC for decades to come.