Summary

- Wells Fargo's stock could rise by as much as 28%, based on bullish options betting.

- The stock currently trades at a steep discount to its peers.

- A return to its historical valuations could leave shares even higher.

- Looking for a helping hand in the market? Members of Reading The Markets get exclusive ideas and guidance to navigate any climate. Get started today »

Wells Fargo's (NYSE:WFC) shares have returned from the dead, helped by rising interest rates and widening spreads. The stock could be heading over the medium term, too, by as much as 28% from its current price of around $29.50 on December 7.

You can track all of my Seeking Alpha articles on this Google spreadsheet.

Improving Macro Conditions

The stock has certainly benefited from returning to the stay-at-home trade as we draw closer to releasing a coronavirus vaccine. This has caused a massive rotation back into "value" stocks and out of "momentum" stocks. Since October 29, the Value ETF (VLUE) has soared by more than 20%.

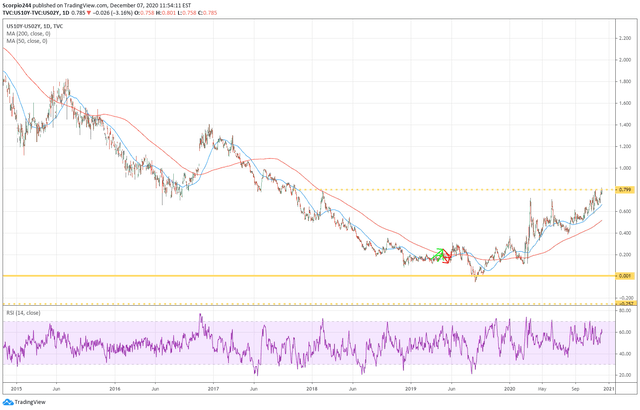

This rotation trade, along with talks of another round of fiscal stimulus from Congress, has resulted in rates on the 10-year yield rising to 93 basis points, from roughly 75 basis points over the same time. Meanwhile, the spread between the 10-Year and the 2-Year has widened to around 80 basis points from 60 basis points, as the spread between the 5-Year and 2-Year has widened to around 25 basis points from 15 basis points.

The widening spreads and rising yield are critical to the banks and their net interest income, which happens to be one of their biggest contributors to revenue.

Rising Earnings Estimates

At this point, analysts have only boosted their earnings estimates for the company slightly. They are now seeing earnings for 2021 at $2.02 per share from $1.97 and $3.28 per share in 2022 from $3.20 from just a few weeks ago. It leaves the stock trading for around 9.0 times 2022 earnings estimates below its five-year average of about 9.7. An earnings multiple of 10, for argument's sake, would easily value the stock at $32.