Summary

- The contingent value right issued to Celgene shareholders after the Bristol-Myers acquisitions are dependent on approval of Liso-cell and Ide-cell.

- For Liso-cell to be approved the FDA seems insistent on inspection of a Texas-based Lonza facility.

- Twitter sources point toward a physical inspection having been initiated at the Lonza facility.

- At the same time the rights have been surging in value.

- In my view this is a highly positive development although it's still possible the contingent value rights will ultimately be worthless.

- This idea was discussed in more depth with members of my private investing community, Special Situation Report. Get started today »

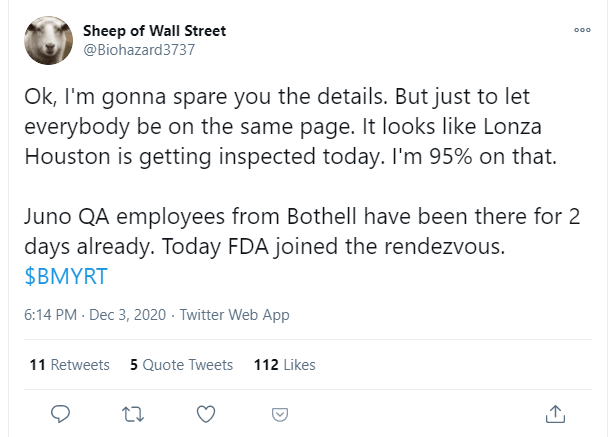

With the developments around the Bristol-Myers / Celgene contingent value right (NYSE:BMY.RT) on Friday, I wanted to issue an update on this dynamic and, at times, hair-raising situation. The recent price surge developed because hedge funds were monitoring the Lonza parking lot. Twitter user, Biohazard3737, is one and posted this on Twitter after the price had been moving quite a bit:

First things first, what is this about?

First things first, what is this about?

This article is about a contingent value right that's publicly traded. It was issued to Celgene shareholders as part of the consideration in the buyout by Bristol-Myers (BMY).

Contingent value rights are unusual securities. This particular one either pays out $0 or $9. There are no other options except through an undesirable route of litigation.

The CVR entitles its owner to receive $9.00 in cash upon FDA approval of all these drugs by the respective dates noted:

- Ozanimod (by December 31, 2020)

- Liso-cel (JCAR017) (by December 31, 2020)

- Bb2121 (by March 31, 2021)

Ozanimod has been approved, which leaves milestones 2 and 3. Remember if these aren't met the rights are zeroed out. If they are both met, the holder receives $9.

At the time of my last article, they were going for $0.66 each. Yet, at the time of another, older, article they were over $3 each. Now they are back up to $2.49 and I think that's very cheap.

The key problem is that Liso-cel requires approval by Dec. 31, 2020.

The fact that it, again, looks like an inspection is going on is fantastic news.

More details about Biohazard's stake-out operation became available. See the video here.

The parking lot observers first noticed cones reserving parking space at the Lonza (OTCPK:LZAGY) facility in the Houston parking lot. At an earlier inspection in Washington, a spot was reserved by putting up a sign saying "FDA." Then at 30-11 Monday a person came in dressed business casual and with a backpack. I believe this person arrived late to stand out to observers.

The same person came in on Tuesday again.